4 Reasons Why Landlords Prefer Collecting Annual Rents Over Monthly Rents in Nigeria

Olaitan Odulaja . 2 years ago

fibre

flexible rent

handyhomesng

kwaba

lagos

landlords in lagos

mono

muster

nigeria

paymyrent

real estate

rent

rent in lagos

rentsmallsmall

residential

spleet

Share this post

Subscribe to our newsletter

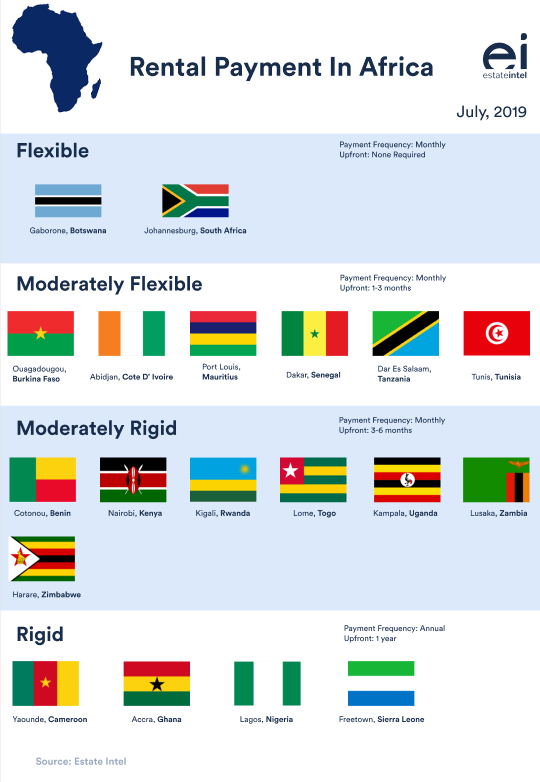

In 2019, we completed some research on how Africans pay rent, based on our findings, 4 out of 19 major African countries including Nigeria require annual upfront payments for rent. In most parts of the world, rents are paid monthly. The implication of the annual rent payment system (as it applies in Nigeria) is that…

In 2019, we completed some research on how Africans pay rent, based on our findings, 4 out of 19 major African countries including Nigeria require annual upfront payments for rent. In most parts of the world, rents are paid monthly. The implication of the annual rent payment system (as it applies in Nigeria) is that prospective home renters, especially those with low to middle income will have to save money for longer periods or resort to borrowing to afford a place to stay.

During 2020, we conducted another survey to determine the rental preferences of tenants in Lagos, especially young people. The goal was to understand which they preferred between yearly, bi-annually, quarterly and monthly arrangements and the reasons they preferred them. To our surprise, the response we gathered showed that 134 (67%) of the 201 young professionals we surveyed preferred to pay their rent annually. Their reasons being that they wanted to sort out their bills at a go rather than paying in bits throughout the year. Property owners especially in Lagos typically demand upfront rental payment of 1 year and most times more, even though the Lagos Tenancy Law considers it illegal for a landlord or his agent to demand or receive rent in excess of 1 year. In this short note, we have identified some of the reasons for this affinity for annual rental payment among Landlords.

1. The housing shortage in Nigeria has made it a landlord’s market

Although there is an argument on what the actual housing shortage figure is, the data points to a nationwide housing gap. The demand and supply mismatch within the residential market has left most tenants at the mercy of their landlords, making renting increasingly competitive, especially in a highly populated city such as Lagos. Landlords exploit the lack of supply by dictating the frequency of rent payment and the amount required as upfront payment. Consequently, such renters are in most cases left with no option than to settle for the terms given by the landlords. Fortunately, as supply grows, this is changing. Regions in Lagos where 2 – 3 years rent were demanded upfront, have since seen a notable decline in these types of requests.

2. Landlords want to minimize void periods/vacancies

When rents are paid monthly, there is a greater chance of tenant churn. This means periods in which the rental units are unoccupied may rise. Since the current dynamic makes the rental space a Landlord’s market, they have the ability to put the security of their income first. The annual upfront payment reduces the administrative cost that may otherwise be expended in managing or following up with rental payments. There is a possibility of losing money due to more frequent void periods that is likely to happen if rents were paid monthly. This risk factor in relation to more frequent voids, is making most landlords prefer annual rental payment against monthly practice.

3. The fear of rental defaults

As the market evolves, we have noted that some landlords are willing to make their properties available to monthly renters. A big concern for them, however, is avoiding defaults or at least understanding and verifying a prospective renter’s financial capacity. Within Nigeria, the credit system is only just developing, and central credit agencies that can provide quick ratings for renters or validate their ability to pay consistently are yet to go mainstream. In western economies, these credit ratings and systems form the basis of welcoming a new tenant and it makes it easy to extend that trust. Although there are new technologies trying to solve this problem such as Mono and a few other agencies, some landlords still see it as a leap of blind faith.

4. Access to Lump Sum Income that can be reinvested

Rental yields in Lagos for example are low, hovering around 5% and 6% on average. With these low yields, landlords try to get as much value as possible sooner through annual rental payments, running upto 2 years in advance in some cases. This capital is typically reinvested in other properties or debt servicing on their existing portfolio.

The Minister of Works and Housing, Babatunde Fashola at the 15th Abuja International Housing Show (AIHS) urged landlords of private properties to collect from tenants monthly, quarterly or half-yearly rents post COVID-19 pandemic instead of the usual annual rent to ease access and affordability of housing for Nigerians. It will, however, take more than an ‘urge’ or prompt; a deliberate attempt needs to be made to restructure the rental space and provide an affordable and flexible payment system. Listed below are some platforms that offer flexible payment plans that enable tenants to pay rent monthly.

Join the conversation on LinkedIn and let us know which payment option you prefer and why in the comment section.

Related News

You will find these interesting

Bisi Adedun . November 14, 2023

Africa Investment Forum

AIF

Bisi Adedun . November 08, 2023

housing

personal finance

Bisi Adedun . October 27, 2023

Century city

New City