5 reasons why Property Prices are Expensive in Lagos' Top Locations.

Research . 3 years ago

Share this post

Subscribe to our newsletter

Lagos’ housing market and the fundamentals behind it are a topic for frequent debate. Outside the difficulty in finding a home in Lagos, a frequently asked question is why the prices are so expensive. In this note, we have outlined 5 reasons why property prices in Lagos’ top locations are expensive, and chief among the…

Lagos’ housing market and the fundamentals behind it are a topic for frequent debate. Outside the difficulty in finding a home in Lagos, a frequently asked question is why the prices are so expensive. In this note, we have outlined 5 reasons why property prices in Lagos’ top locations are expensive, and chief among the reasons include the city’s large population and underserved housing demand.

Underserved Housing Demand

The number of housing units available in Lagos is not sufficient for the population. According to the Pison Housing Group’s 2019 report, the housing stock in Lagos is estimated to be 1.492 million units. With a population of 18 million people in 2019 according to the United Nations and average household size of 4.9 according to a report by Renaissance Capital, Lagos had over 3.8 million households, indicating that there are up to 2.1 million households that are without formal housing. This presents a supply gap of over 55%. As typical in every market, excess demand drives up prices. Landlords who frequently get requests for their available spaces tend to increase the prices and let it out or sell to the highest bidder.

Construction cost and land price

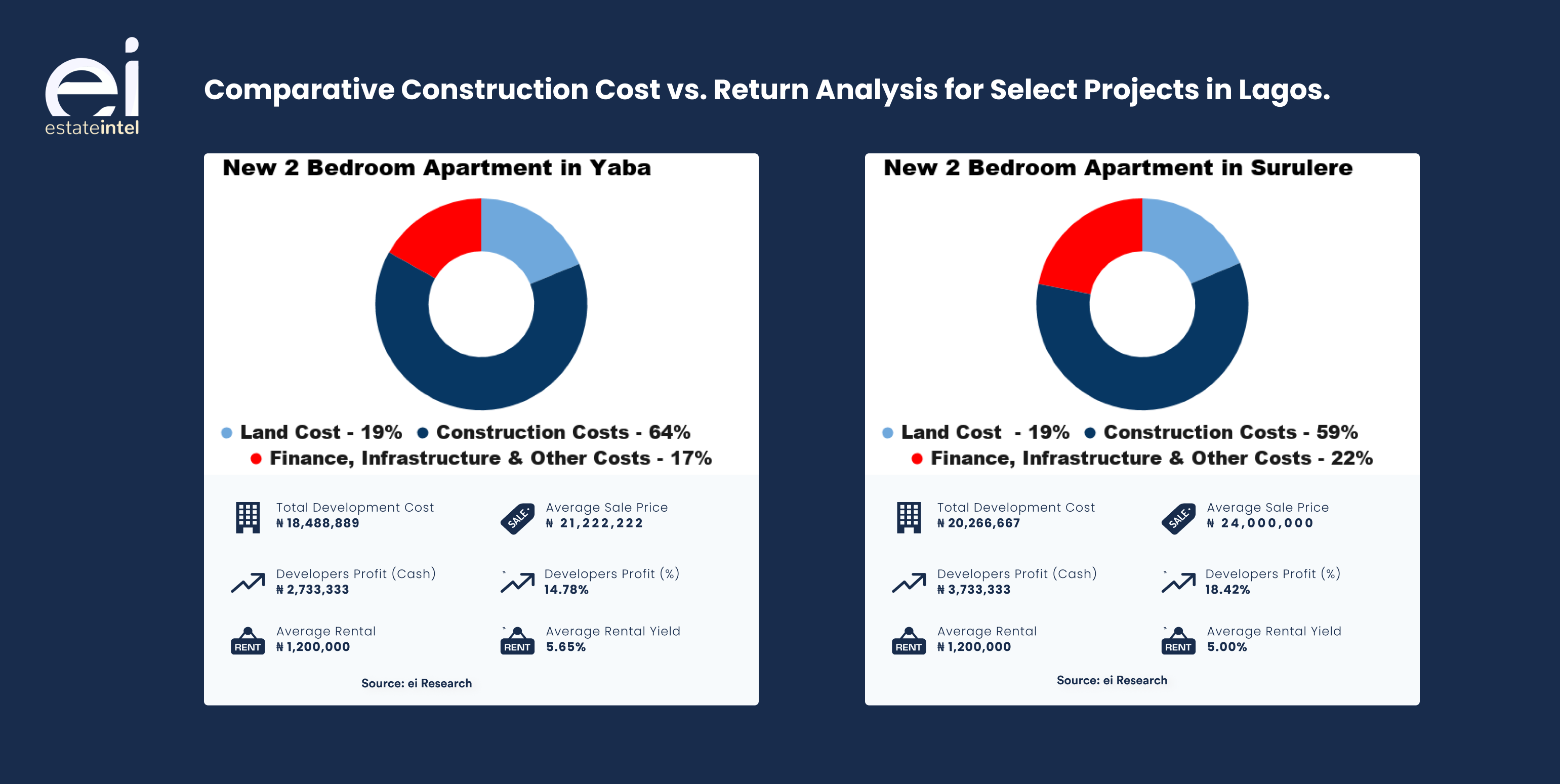

The high cost of acquiring land, including the actual cost of building, also adds to the reasons why property prices in Lagos are high. We analyzed four brand new projects in Banana Island, Ilasan, Yaba, and Surulere. With sale prices ranging between 21m to 24m for the 2-bed apartment in Yaba and 620m for a 6-bed house in Ikoyi, all developers maintained profits ranging between 15% and 36% and rental yields of 2% to 7%. Our analysis shows that land acquisition and construction costs contributed 22% and 64% to the total cost of development respectively, for the Ikoyi project, however, the split was 53% and 47% respectively. The skew is due to the fact that Ilasan, Yaba, and Surulere (with an average land price of ₦78,000 per sqm) are relatively cheaper than the more pronounced Ikoyi (Banana Island where the developer bought the land at ₦400,000 per sqm). A developer in an area where land costs are high will aim to sell for higher prices, where a greater finish (and by implication greater construction cost) is required.

The case studies below will help put rents and sale prices into context:

Excessive speculation and hikes in Land Prices

Land is a scarce commodity and locations that are close to commercial and recreational activity such as Lekki etc create demand and push up prices. However, these price increases are not always rational.

Availability of a large expanse of land in prime locations such as Ikoyi (especially Banana Island), Victoria Island, and Lekki Phase 1 is limited. As a result, the few landowners are increasing their prices to record levels, even in the face of high vacancies in some properties. For instance, to our surprise, early last year, asking prices for land in Banana Island were around ₦400,000 to ₦600,000 per square meter early last year, but are now selling for as high as ₦800,000 to ₦1,000,000 per square meter. Developers who are not building for their personal occupation but rather for commercial investment will push these prices to the buyers of the final product.

Non-Institutional Capital

Developers with equity funds, and no loan exposure, have more flexibility in the market, and maybe willing to keep their properties unrented/unsold for a longer period. Private developers who are building with private funds can afford to stay resolute on achieving ridiculously high prices because they are not under loan pressure or accountable to any institution. This is very different from developers with loan exposure who may want to rent/sell at market prices to offset their loans or keep to their promise to their investors.

Lack of transparency between asking and achievable

Multiple agents and developers typically list properties significantly higher than what they are prepared to achieve. While we expect developers or agents to aim to achieve the highest possible price, with a window for negotiation, leaving a wider than usual spread between asking and achievable prices. A large spread in between asking and achievable rent makes average market rent seem artificially high and encourages other developers to hold fast on those artificially listed prices, keeping average rents or sale prices high. This is very misleading especially because most of the properties on the listed platforms in Nigeria are priced well above what is achievable.

What do you think? Join the discussion on LinkedIn and keep visiting estateintel.com to read more related articles on Africa’s real estate market.

Related News

You will find these interesting

Bisi Adedun . April 15, 2024

asaba mall

Delta Mall

Bisi Adedun . April 05, 2024

andmark tower

Lagos-Calabar highway

Bisi Adedun . March 19, 2024

Airtel Business under its Nxtra arm recently conducted the groundbreaking for their new data centre facility in Lagos, N...

airtel nxtra

Data Centres