An upbeat week of announcements for African hotel markets

Research . 6 years ago

Addis Ababa

Algiers

Arusha

BON Hotels

Douala

hilton

Hotel Franchise Agreements

Share this post

Subscribe to our newsletter

It was a week of major announcements of growth plans for Africa by international hotel companies. Announcements came from U.S. based Hyatt and Hilton to significantly increase their footprints in Africa over the next few years. HYATT In a press release on Tuesday, October 3rd, Hyatt announced its plans to open six new hotels in…

It was a week of major announcements of growth plans for Africa by international hotel companies. Announcements came from U.S. based Hyatt and Hilton to significantly increase their footprints in Africa over the next few years.

HYATT

In a press release on Tuesday, October 3rd, Hyatt announced its plans to open six new hotels in Africa – in Algeria, Cameroon, Ethiopia, Senegal, Morocco, and Tanzania. The U.S. based hotel company already operates four existing hotels in Morocco and Tanzania, while the planned hotels will be the first for the other four. These new hotels will be expected to create approximately 2,100 new jobs once open.

According to Peter Penev, Vice President, Acquisitions & Development, “The development opportunities for Hyatt in Africa are significant, and we see enormous potential in the region. This expansion reinforces our commitment to developing our pipeline in Africa”. The Pan-African passport is expected to improve connectivity within the continent, and catalyze the growth of regional airlines, particularly in East Africa. The region will be a primary focus area for the company in the short term, benefiting from continued government investment in infrastructure, a growing middle class and international recognition of its economic growth and stability. According to the UNWTO World Tourism Barometer, East Africa experienced an increase of 14% in international arrivals in the first half of 2017, compared to the same period in 2016.

The planned hotels will introduce the Hyatt Centric brand to the African market, and also increase the presence of the Hyatt Regency and Park Hyatt brands. The planned hotels include:

Hyatt Regency Algiers Airport, Algeria: a 326-room hotel to be located opposite the Algiers Airport new terminal (and linked to the terminal). The hotel is expected to open in late 2018.

Hyatt Regency Douala, Cameroon: a 200-room hotel with 1,200 sqm of meetings and conference, located on a 2-acre site in the Bonanjo district of the city. The hotel is planned to open in late 2020.

Hyatt Regency Addis Ababa, Ethiopia: a 180-room hotel developed in the central Kirkos district of the city. The hotel is scheduled to open in the summer of 2018.

Hyatt Regency Arusha, Tanzania: a 144-room hotel in Tanzania’s third largest city. The hotel will occupy a 29-acre site in the center of the city, and will join two existing Hyatt properties in Tanzania in early 2019.

Park Hyatt Marrakech, Morocco: will be a 120-room hotel, with residential and retail components, within the Al Maaden Golf and Resort of Marrakech. The development will have 45 private villas which will have a living room, dining room, fireplace and pool. The resort complex will feature a Moroccan garden-inspired 18-hole golf course, designed by award-winning golf course designer Kyle Phillips. The hotel will join two existing Hyatt hotels in Morocco, and is expected to be completed by early 2019.

Hyatt Centric Kermel Dakar, Senegal: will be a 140-room hotel and the first Hyatt Centric-branded hotel in Africa. The hotel will be located in the Plateau district of Dakar, near the popular Kermel market. It is expected to open in the summer of 2018.

Hyatt also plans to sign new deals in countries like Rwanda, Kenya, Uganda, Mozambique, Ghana and Côte d’Ivoire. Its existing hotels are in Johannesburg, Dar es Salaam, Casablanca, Sharm El Sheikh, Zanzibar, Taghazout Bay.

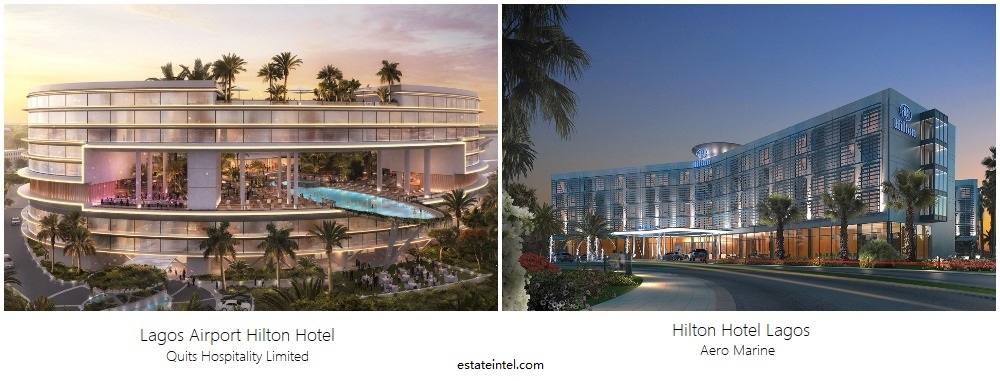

HILTON

On Thursday, October 5th, Hilton reiterated its commitment to expand its sub-Saharan African hotel portfolio, with the Hilton Africa Growth Initiative. The company will invest a total of $50 million over the next five years to support the initiative. Funds will be deployed to support the conversion of around 100 existing hotels (about 20,000 rooms) in various African markets to its Hilton, DoubleTree by Hilton and Curio Collection brands. The company’s Senior Vice President of Development, Middle East & Africa, Patrick Fitzgibbon, remarked in the press statement that Hilton has successfully executed the model of conversions of existing properties to expand its brand, in various other markets. He said, “it enables us to rapidly grow our portfolio and delivers returns for owners by increasing exposure of their business to more international, inter-regional and domestic travellers,” allowing for expanded development in key cities and airports, as well as resorts and safari lodges.

This initiative has already resulted in the signing of two hotels in Kenya and Rwanda:

DoubleTree by Hilton Nairobi Hurlingham, Kenya: This will be the conversion of the 109-room Amber Hotel, Nairobi to a DoubleTree by Hilton brand. The hotel opened in 2016, and is currently undergoing renovations before it becomes absorbed into the brand by the end of 2017. Although the hotel will be branded by Hilton, it will continue to be managed by the owner under a franchise agreement.

DoubleTree by Hilton Kigali City Center, Rwanda: This will be a conversion of the 153-room Ubumwe Grande Hotel in Kigali’s CBD. The hotel, which consists of 134 guest rooms and 19 apartments opened in September 2016, and will also require some renovation for its conversion. The hotel will also operate under a franchise agreement.

The signing of these two deals is an interesting, and perhaps welcome, departure from the traditional model of signing hotel management contracts, by international hotel companies seeking to expand in Africa. The major hotel companies have grown their pipelines rapidly in the more developed markets, particularly in the U.S., utilizing franchise agreements. A franchise agreement basically grants the hotel owner the right to operate the hotel under its brand, either directly or through a third-party hotel manager. The hotel franchise agreement differs from the management agreement because it allows the hotel brand expands its portfolio rapidly, without deploying resources to operate the hotels directly. Franchise agreements have also allowed the growth and expansion of third-party, or “white label” hotel managers.

Earlier in the year, in the pipeline report published by W Hospitality Group, Hilton reported a hotel pipeline of 41 hotels (approximately 9,000 rooms) for the African continent. With 38 existing hotels, (approximately 11,000 rooms), an increase of 100 hotels (about 20,000 rooms) over the next five years represent a 180% increase in rooms.

Related News

You will find these interesting

Research . June 29, 2020

Douala

Research . June 27, 2020

Douala

Infographic

Dolapo Omidire . April 15, 2020

hilton

hospitality