Achimota Mall and Circle Mall - which do you think will fare better in the long run?

Dolapo Omidire . 4 years ago

Share this post

Subscribe to our newsletter

Even though institutional investment in modern shopping centres within West Africa is a concept a few years older than a decade, the market has been through some rough cycles. Large pan African funds, indigenous investors and others with capital, are currently grappling with the realities of volatile African markets, which have changed and are still…

Even though institutional investment in modern shopping centres within West Africa is a concept a few years older than a decade, the market has been through some rough cycles. Large pan African funds, indigenous investors and others with capital, are currently grappling with the realities of volatile African markets, which have changed and are still evolving much faster than initially imagined. In this brief note, we profile two relatively similar shopping centres, completed at a time when market sentiment towards investment-grade real estate in sub-Saharan Africa was much stronger and ask you to tell us which you think will fare better in the long run and why. Though located in different West African countries, both malls are in comparable regions, they have very many similar physical characteristics and were also executed by investors from the same background.

To begin with, large scale pan African fund backed investment in real estate commenced with the establishment of funds led by the likes of Actis (AARE I & II), RMB Westport (REDF I & II), African Capital Alliance (CAPIC) among others. These funds developed flagship retail centres in Nigeria and Ghana (The Palms in 2005 and Accra Mall in 2006 respectively) and went on to execute many other investments. By 2015, when Achimota and Circle Mall were completed, Nigeria’s retail market was at the tail-end of a phase we termed The Boom & 2nd Tier City Expansion (2009 – 2015), moving quickly towards the Recession. Retail space in Nigeria had grown 40% annually within this period and many investors who decided to venture into the smaller, non-core cities, met tiny markets that fundamentally struggled to support large scale investment. With a few active case studies of large shopping centres already existing, a key point of interest for investors at this time were smaller strip malls which cost less and could be rolled out faster. These were expected to be more suitable for the demographic profiles of the ideal customers in these markets.

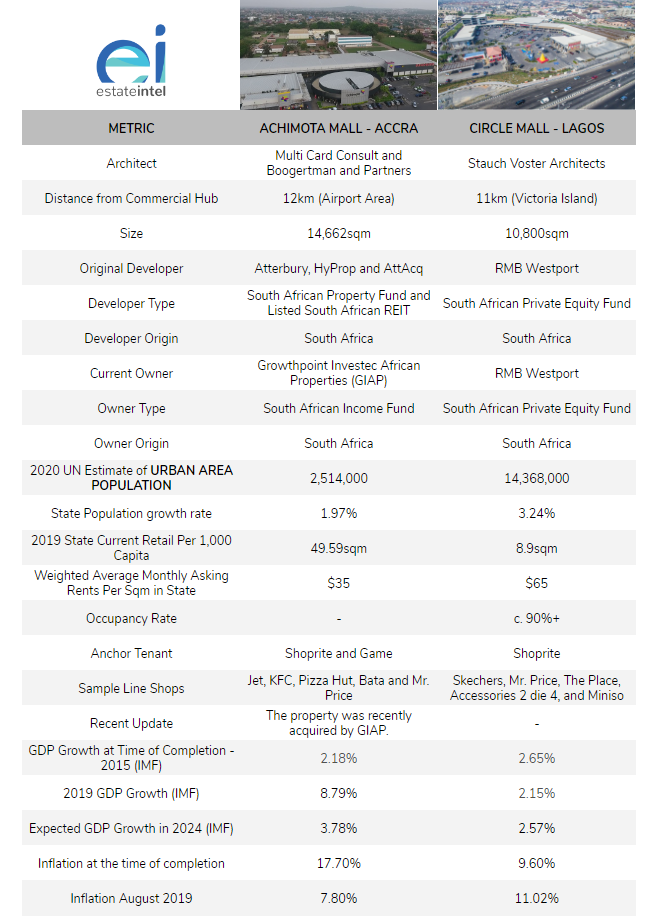

Achimota and Circle Mall were pioneer investments in this regard, deliberately built as smaller strip malls. See the table below for a profile.

Comparison of Achimota and Accra Mall

Achimota Mall has a gross lettable area of 14,622m2 and is anchored by Shoprite and Game. It is located in Achimota, a residential neighbourhood situated to the North of core Accra and is 12km away from major hubs including Ridge and the Airport Area. It was developed by Atterbury, South African fund investors alongside a local partner but was recently acquired by Growthpoint Investec African Properties.

Circle Mall (originally called Osapa Mall) is a 10,800m2 mall also anchored by Shoprite located in Osapa, a residential suburb located along the Lekki Epe Corridor towards Eastern Lagos. Akin to the former, it is located 11km from the core regions of Victoria Island in Lagos and was developed by RMB Westport alongside their local partners. Circle Mall is currently on the market for potential investors.

Circle Mall, Lagos – Floor Plan

Both malls are anchored by Shoprite and were unusually completed without the typical cinema sub anchor. For Circle Mall, however, a cinema is currently being included. Line shop retailers in Achimota Mall include Jet, KFC, Pizza Hut, Bata and Mr. Price. Line shops in Circle Mall include Skechers, Mr. Price, The Place, Accessories 2 die 4, and Miniso among others.

Though both are open-air strip malls, Multi-Card Consult and Boogertman and Partners, who designed the Achimota Mall arguably achieved a better sense of placemaking and visitor experience by creating pathways with an internal look and feel that provide good direction for visitors, in lieu of the standard U shaped strip mall format.

Achimota Mall, Achimota – Greater Accra, Ghana. Image Source: Estate Intel

Achimota Mall – Floor Plan

On the other hand, Circle Mall wins many points for its location, which is surrounded by more than a handful of large scale multi-family residential estates, all of which at the very least require groceries and the occasional quick-service restaurant. Altogether, this comes as a strong upside for the mall, especially Shoprite. This, however, is slightly dampened due to some tight competition from big grocer/stand-alone retailers such as Ebaeno and Spar also located nearby.

In August 2019, both malls had strong occupancy rates, commendable even if achieved with notable rental concessions. Average market rents in Lagos and Accra are $60/m2/month and $35/m2/month respectively, however, it is important to note that both countries have significantly varying profiles for factors such as land prices, operational costs and inflation.

Relative to Nigeria, the Ghanaian economic and political landscape is known for greater stability. In 2019, Ghana is expected to grow at 8.79%, compared to the relatively flat 2.57% expected from Nigeria in the same period. While Ghana is currently growing faster than Nigeria and even provides a softer landing for retailers looking to enter the West African region, many market participants argue that Nigeria has a greater market potential due to its large, young and entrepreneurial population. Regrettably, without the right reforms, Nigeria’s attractive young population may prove to be more of a social and economic liability, rather than a benefit.

It’s a mixed performance basket with many moving pieces. With the information provided which mall do you think will fare better in the long run?

Related News

You will find these interesting

Bisi Adedun . 6 months ago

Jabi is an area located within the phase 2 vicinity of the Abuja Municipality, known for housing the iconic Jabi Lake. I...

abuja

Jabi Lake

Tilda Mwai . 7 months ago

africa

Africa real estate outlook

Deborah Jesusegun . 10 months ago

African

building