Earnings Report Overview - UPDC REIT FY:2018

Research . 4 years ago

Share this post

Subscribe to our newsletter

[caption id="attachment_15002" align="aligncenter" width="1366"] Earnings Report Overview - UPDC REIT FY:2018[/caption] Earlier this month, UPDC REIT released its full-year audited financial statements for the year ended 31 December, 2018. It reported a Profit After Tax of ₦2.64 Billion, which is a 19.76% increase from the previous year. The improved performance is a result of the…

Earnings Report Overview – UPDC REIT FY:2018

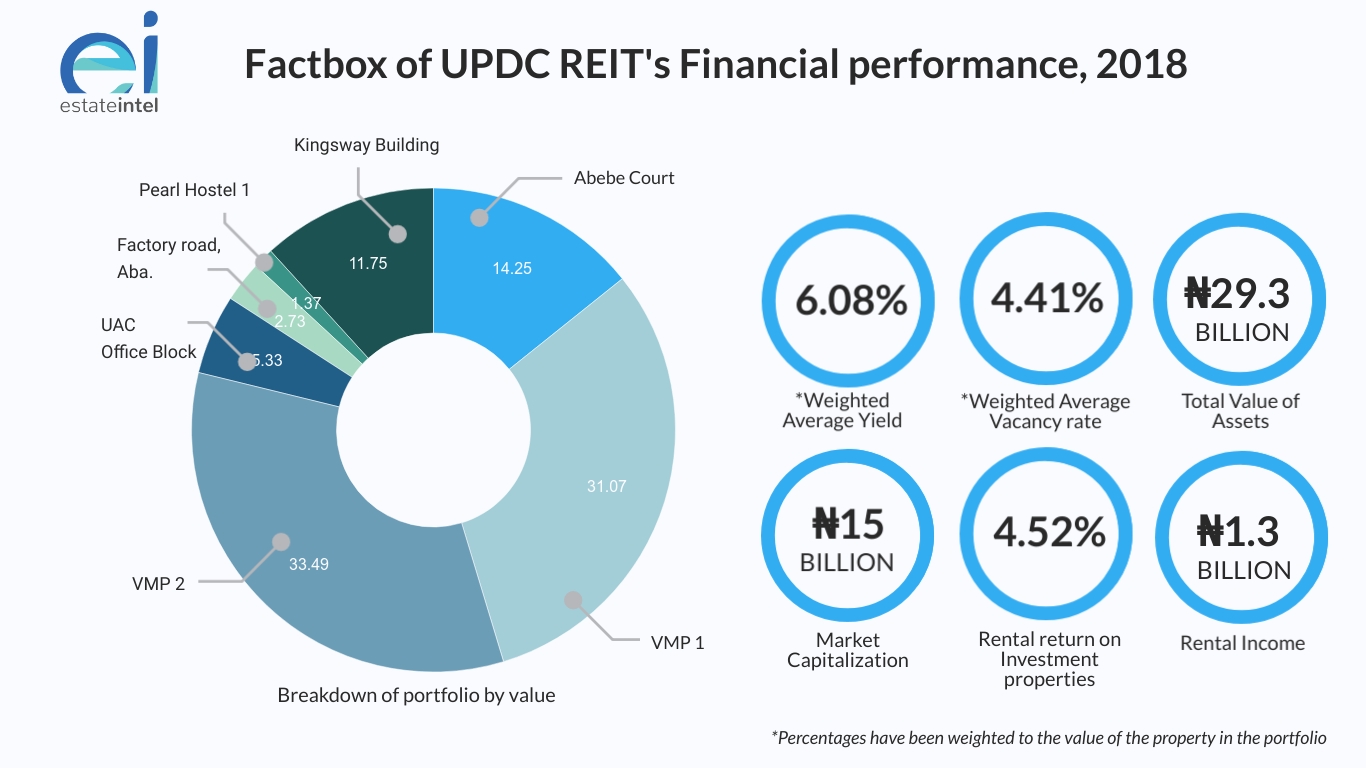

Earlier this month, UPDC REIT released its full-year audited financial statements for the year ended 31 December, 2018. It reported a Profit After Tax of ₦2.64 Billion, which is a 19.76% increase from the previous year. The improved performance is a result of the 17.79% growth in rental income and 397.75% increase in the fair value of investment property owing to the additions of Kingsway Building, Marina and Pearl Hostel, Ibeju-Lekki.

Pearl Hostel, Ibeju-Lekki is currently valued at ₦405 Million with a current yield of 6.65% and a vacancy rate of 11%. The Kingsway Building, Marina which was acquired from UACN Property Development Company (UPDC) is currently valued at ₦3.2 Billion with a current yield of 5.73% and a vacancy rate of 0%.

Earnings Report Overview – UPDC REIT FY:2018

As at 31 December 2018, UPDC REIT had a market capitalization of N15bn while its last trading price fell from N8.10 to N6.60. It is managed by FSDH Asset Management. The net assets attributable to unit holders grew by 19.7% to ₦2.6 Billion and net assets attributable to equity holders grew by 4.2% to ₦32.5 Billion as at 31 December 2018. The portfolio’s weighted average yield and vacancy rate (by property value) stood at 6.08% and 4.41% for the year ended, respectively.

UPDC REIT is making commendable efforts to position itself for growth in the coming years through its renewed management team which was announced in September 2019, its reduced operating costs and improved cash management.

Last month, the company announced an unbundling exercise aimed at streamlining UAC’s capital structure. In addition to owning shares in UAC, UAC shareholders can now own shares in both UPDC and UPDC REIT. The previous structure required UAC shareholders to own shares in UPDC first, before they could own shares in UPDC REIT. This means that UPDC REIT is now a free-standing entity pursuing its own growth initiatives. To this end, they also recently revealed plans to raise ₦15.96 Billion capital through a rights issue.

Earnings Report Overview – UPDC REIT FY:2018

Download all UPDC Financial Statements and those for other REITs on the Financial Reports section of the Web App.

Related News

You will find these interesting

Bisi Adedun . 6 months ago

Jabi is an area located within the phase 2 vicinity of the Abuja Municipality, known for housing the iconic Jabi Lake. I...

abuja

Jabi Lake

Tilda Mwai . 7 months ago

africa

Africa real estate outlook

Deborah Jesusegun . 10 months ago

African

building