Research Note: It is time for Nigerian REITs to ditch residential properties

Research . 4 years ago

Share this post

Subscribe to our newsletter

There are three listed REITs on the Nigerian Stock Exchange with a total market size of ₦24.9 Billion as of Oct. 31st, 2019. Though it represents the largest property sector in any country, Nigerian residential assets typically produce the lowest income/rental yields between 5 and 6%. So why do Nigerian REITs, who have an investment…

There are three listed REITs on the Nigerian Stock Exchange with a total market size of ₦24.9 Billion as of Oct. 31st, 2019. Though it represents the largest property sector in any country, Nigerian residential assets typically produce the lowest income/rental yields between 5 and 6%. So why do Nigerian REITs, who have an investment mandate of growing income choose to give the residential sector such a large focus?

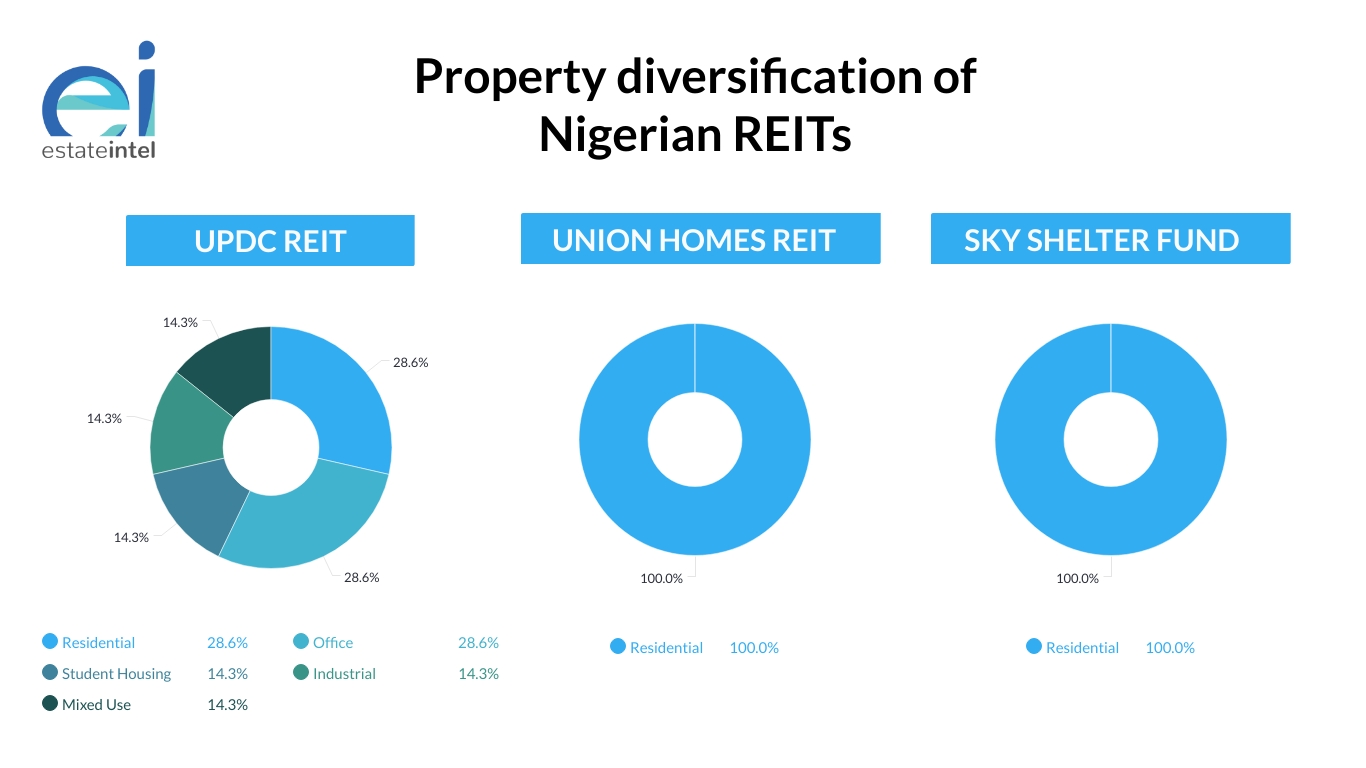

Though real estate, in general, has not been competitive with other asset classes in recent years, UPDC REIT recorded the highest average rental yield at 5.19% between 2015 and 2018. It dominates the Nigerian REIT industry by controlling 71.8% of the total investment properties owned and 52.4% of Nigeria REIT Market Cap. Union Homes REIT and Skye Shelter Fund own only residential properties recording similarly unimpressive rental yields of 4.75% and 2.91% respectively between 2015 – 2018. UPDC REIT, however, has a well-diversified property portfolio cutting across different sectors including residential, office, student housing, industrial and mixed-use developments.

It is time for Nigerian REITs to ditch residential properties

Source: Nigerian Stock Exchange (NSE)

The total value of investment properties and total market cap for Nigerian REITs was ₦40.8 Billion (Dec. 2018) and ₦24.9 Billion (Oct. 2019) respectively. To give you some context, Ikeja City Mall in November 2015, sold for a price higher than the current market cap of Nigerian REITs! The market cap of all Nigerian REITs accounts for 0.09% of the entire stock exchange much less than other REIT regimes across the world. Check out the illustration below to see how Nigeria compares.

It is time for Nigerian REITs to ditch residential properties

The illustration below shows the proportional value each REIT holds:

It is time for Nigerian REITs to ditch residential properties

Source: Nigerian Stock Exchange (NSE), Financial statements of REITs

How will UPDC REIT perform with no residential properties?

As seen below, UPDC REIT’s lowest-performing assets are residential properties namely Abebe Court and Victoria Mall Plaza 1 (VMP) with rental yields of 4.19% and a disappointing 2.04%. Earlier in the year, a representative of UPDC explained that their student housing project is now their highest yielding asset in 2019. We tried playing around with the portfolio and found that if UPDC REIT’s portfolio had no residential properties, its average yield will increase by 105bps to 6.79%. A marginal but meaningful increase, creating a case for a deliberate approach towards stronger property diversification away from the residential sector.

It is time for Nigerian REITs to ditch residential properties

How do rental yields of Nigerian REIT’s size up with the risk-free benchmark?

Yields from treasury bills averaged 15.37% between 2015 to mid-2019. For many multi-asset portfolio managers, This made a strong case against investments in real estate, because unlike the latter, investments in treasury bills not only gave higher returns but are risk-free. However, it is worthy to note that real estate returns are not only from rental yield but also generate capital gains from the sale of the property. Therefore, it is arguable that although treasury bills give a higher income return, capital gains from property investments make my return superior depending on its location.

It is time for Nigerian REITs to ditch residential properties

Source: Bloomberg Terminal, Financial statements of REITs.

The graph above compares the rental yield of Nigerian REITs with the average yield from treasury bills for each year from 2015 – 2018. In this time frame, treasury bills have consistently out-performed rental yields from REITs, and this has been the case historically. Things got even worse for REITs in 2017 when treasury bills had yields as high as 19.89% when efforts were aimed to encourage foreign investors to bring in capital into the country. In that same year, the rental yield from Union Homes REIT was 1.76%, lower than the inflation rate and 1030% lower than treasury bill yields. With figures like this, it is clear why many have little faith in Nigeria’s REIT industry.

How about other African countries?

It is time for Nigerian REITs to ditch residential properties

Source: Financial Statements of REITs

From the illustration above, we can deduce that Growthpoint Properties and STANLIB I-REIT have no residential properties in their portfolios while Watumishi Housing Company (WHC) REIT is a fully residential portfolio.

Growthpoint Properties is used as a case study to represent other South African REITs as it is the largest and most liquid South African primary listed REIT and also a JSE Top 40 Index company with a market capitalization of R72.1 billion ($5.1 billion) as of June 2019. STANLIB Fahari I-REIT and WHC REIT are the only REITs present in Kenya and Tanzania respectively.

How are their rental yields performing?

It is time for Nigerian REITs to ditch residential properties

Source: Bloomberg Terminal (Dec. 2018), Financial Statements of REITs.

The treasury bill rates floor the rental yield from UPDC REIT, Nigeria and WHC REIT, Tanzania. Rental yield from STANLIB I-REIT, Kenya comes close to its risk-free rate while Growthpoint properties, South Africa generates higher rental yield than its risk-free rate. Observe how the portfolios of STANLIB Fahari I-REIT and Growthpoint properties are non-residential focused, They instead focus on the office, retail and industrial sector.

The Watumishi Housing Company REIT (WHC-REIT) is the main implementer of the Tanzania Public Servant Housing Scheme tasked with building of 50,000 housing units in five phases commencing from FY 2014/2015. It is another fully residential REIT generating poor rental yields.

What then?

As we all know, Nigeria’s REIT industry is still very much nascent and needs as much support from the macroeconomic and regulatory environment as it can get. It still faces problems such as improper taxation structure, expensive assets and much more. Outside the macroeconomic challenges that need to be addressed, Nigerian REITs keen on generating higher rental yields need to make deliberate efforts towards the diversification of their portfolios, especially away from residential properties.

Related News

You will find these interesting

Bisi Adedun . October 12, 2023

Jabi is an area located within the phase 2 vicinity of the Abuja Municipality, known for housing the iconic Jabi Lake. I...

abuja

Jabi Lake

Tilda Mwai . August 23, 2023

africa

Africa real estate outlook

Deborah Jesusegun . June 02, 2023

African

building