Listed Real Estate in Eastern Africa and Beyond - What Next?

Dolapo Omidire . 7 years ago

africa

api

eapi

east africa

event

kenya

reits

Share this post

Subscribe to our newsletter

East African property markets have demonstrated desirable levels of resilience over the past few years. As African economies including Angola, Nigeria, Zambia and Ghana have reeled from commodity price induced recessions, better diversified countries in the East African region including Kenya have demonstrated strength. The region has seen investments from the major players such as Actis…

East African property markets have demonstrated desirable levels of resilience over the past few years. As African economies including Angola, Nigeria, Zambia and Ghana have reeled from commodity price induced recessions, better diversified countries in the East African region including Kenya have demonstrated strength.

The region has seen investments from the major players such as Actis through the Garden City project in Kenya, Sanlam Core Africa Real Estate Fund via Capital Properties in Tanzania as well as Stanlib’s recent investment into Arena Mall in Uganda among many others.

Two Rivers Mall, Kenya. Image Source: nation.co.ke

Without the presence of an active secondary market for commercial real estate assets across Sub-Saharan Africa (ex. SA) however, or an opportunity for investors to exit at their preferred terminal dates, it is hard for deal flow to continue. This points to a major issue facing Sub-Saharan African (ex. SA) real estate markets. Liquidity.

One solution available in developed markets are Real Estate Investment Trusts (REITs). In Africa however, restrictive legislation, poor knowledge and understanding of the industry have been a hinderance to its growth and larger adoption. According to JLL Africa:

- Nigeria has three publicly traded REITs with a market capitalisation of approximately $100 million;

- Kenya has one publicly traded REIT with a market capitalisation of $25 million;

- Tanzania has one newly listed publicly traded REIT with a market capitalisation of $31 million;

- Ghana has one publicly traded REIT with a market capitalisation of $11 million;

- These add up to $167m, exceptionally small when compared to South Africa’s total REIT market cap of c. $33bn from 36 REITs, which still lags global counterparts significantly.

Why have REITs not taken off? Legislation typically sits at the centre of the reasons why REIT markets do not thrive, especially because of the tax incentives they offer. South Africa had to manage a different trust scheme until they received improved ‘REIT-ish’ legislation; and these legislative improvements required years of regulator and stakeholder engagement. Similarly, Nigerian asset managers frequently hold seminars with capital market regulators, tax regulators, pension fund regulators to push for the industry to develop.

During the East African Property Investment Summit, of which estate intel is a proud Media Partner of, more will be discussed on the East African REIT industry during a panel called ‘Beyond the First Hurdle, REITs and Listed Property’. The panel will have representatives from Fusion Capital Kenya, Stanlib, JLL, the Rwanda Stock Exchange and Burbridge Capital.

Find out more about the event on the ei Event and Conference page.

Related News

You will find these interesting

Linah Amondi . August 31, 2023

affordable housing

africa

Linah Amondi . August 04, 2023

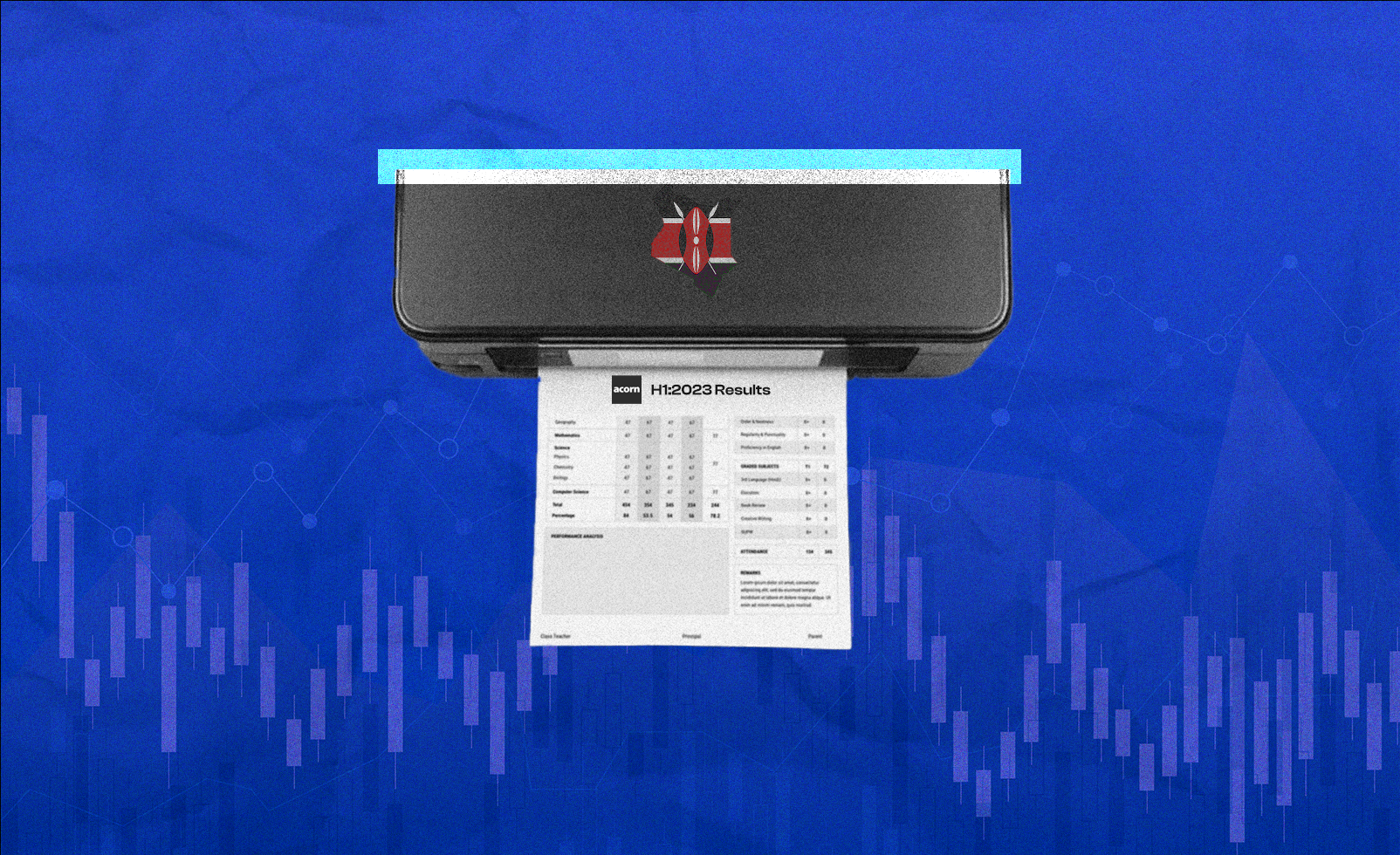

acorn

reits

Linah Amondi . August 04, 2023

LAPTRUST Imara I - REIT

reits