P&G Nigeria is Leaving. Here Are Their Real Estate Assets

Bisi Adedun . 4 months ago

FMCG

Industrial market

Manufacturers

Market Exits

P&G Nigeria

Share this post

Subscribe to our newsletter

The Nigerian arm of Procter & Gamble (P&G), an American multinational consumer goods company, is officially dissolving their ground operations in Nigeria. The chief financial officer, Andre Schulten, cited difficulty emanating from the country's macroeconomic environment and limitations in creating US dollar value.

The Nigerian arm of Procter & Gamble (P&G), an American multinational consumer goods company, is officially dissolving their ground operations in Nigeria. This follows the announcement made by the chief financial officer, Andre Schulten, where he cited difficulty emanating from the country’s macroeconomic environment and limitations in creating US dollar value. Consequently, the company will cease all local production within Nigeria and resort to an import-only model.

P&G Nigeria’s Real Estate Assets

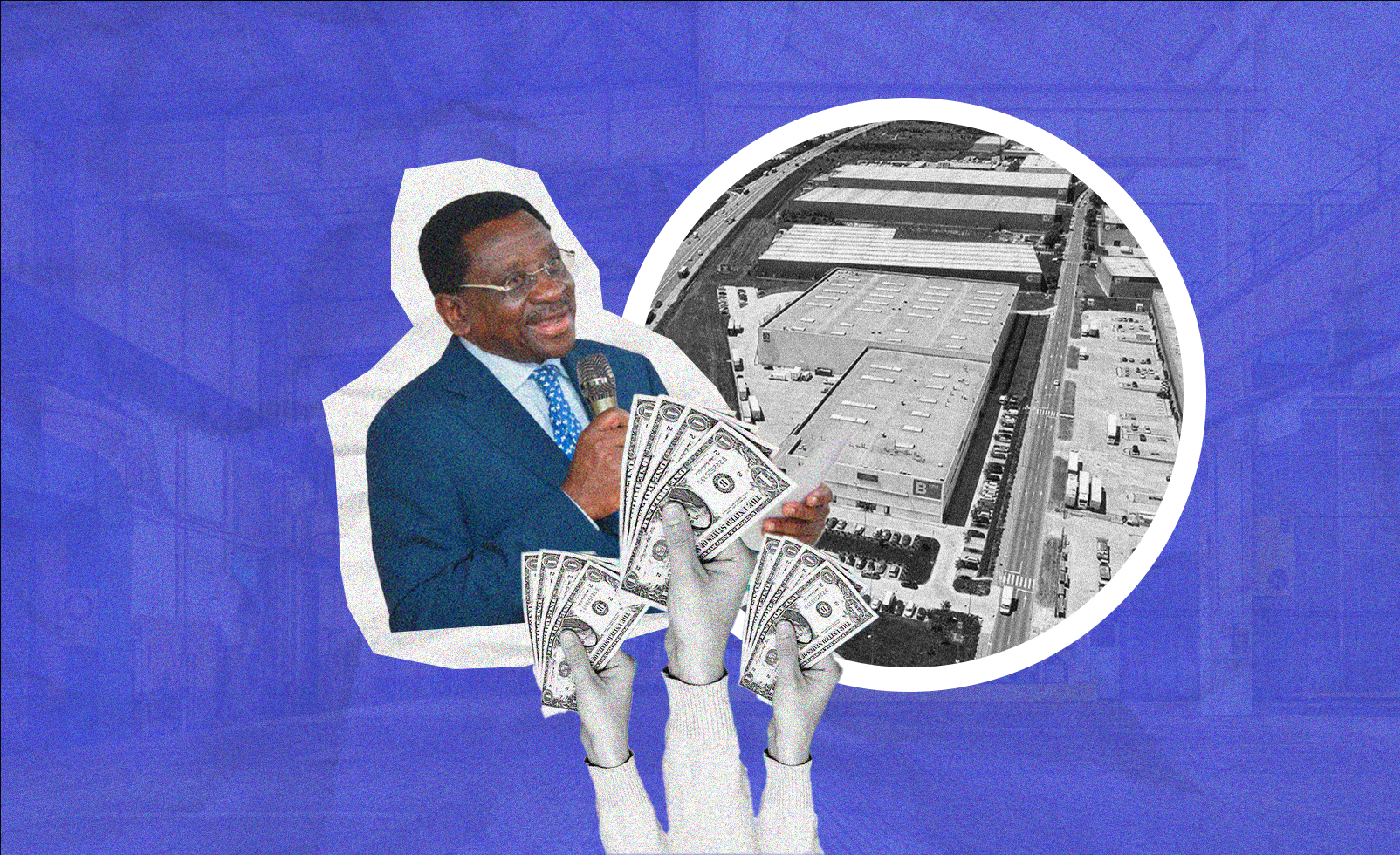

According to Andre Schulten, P&G Nigeria is a $50 Million net sales business, which is just 0.05% of their overall $85 Billion global portfolio. As of December 2023, the company occupied office space in Landmark House, Ikeja and was operating one manufacturing plant in Nigeria, with the following details:

-

P&G Nigeria Manufacturing Plant, Ibadan

The P&G manufacturing plant is located in Oluyole Estate in Ibadan and the only plant that was run by the company by December 2023. Here, the company manufactured only Ariel detergent with their other products either being imported or outsourced to be produced by other companies. Details on the plant below:

P&G Manufacturing Plant, Ibadan. Source: Google

P&G Manufacturing Plant, Ibadan. Source: Google

Location: Oluyole Estate, Ibadan

Area Industrial Rental Range/Annum: ₦10,000 – ₦15,000

Their other real estate assets during their course of operation in Nigeria, include:

-

Former P&G Healthcare Plant, Ibadan

The P&G Healthcare Plant was one of the two plants being run in Oluyole Estate Ibadan. In 2017, the plant was acquired by Elixir Global Manufacturing Food Ltd due to losses accrued by P&G from operating the plant. Further to the acquisition, Elixir Global also obtained the rights to manufacture and sell Vicks Lozenges from P&G within Nigeria and Sub-Saharan Africa for up to 20 years. Details on the plant below:

P&G Healthcare Plant, Ibadan. Source: Google

P&G Healthcare Plant, Ibadan. Source: Google

Location: Oluyole Estate, Ibadan

Year Sold: 2017

Area Industrial Rents: ₦10,000 – ₦15,000

-

P&G Nigeria Manufacturing Plant, Agbara

P&G Nigeria’s manufacturing plant in Agbara was one of the biggest investments by a non-oil US company in Nigeria at the time. The plant, located in Agbara, Ogun State, encompassed an area of about 56,000m2 and cost $300 million to build. Following its commissioning in 2017, the company closed the plant a year later citing cut-throat competition and difficulty maneuvering their way into the system. Details on the plant below:

P&G Healthcare Plant, Agbara. Source: Google

P&G Healthcare Plant, Ibadan. Source: Google

Location: Agbara, Ogun State

Year Built: 2017

Year Closed: 2018

Size: 56,833m2

Area Industrial Rental Range/Annum: ₦5,000 – ₦9,000

The Company’s Import-Only Model Will Cause an Increase in the Cost of their Products

According to McKinsey, P&G is one the major FMCG companies in Nigeria with a healthy share of the consumer goods market. Their products -which includes Ariel, Vicks Lemon Plus, Tide, Pampers, Pringles, and Duracell – are widely distributed across the country and utilized in almost every household. As such, the company’s impending exit and adoption of an import-only model is likely to lead to an increase in the cost of their products at a time when headline inflation in Nigeria is at 27.33% (as of October, 2023) according to the NBS.

P&G is one of several major multinational FMCG Exits in 2023

In conclusion, Procter and Gamble’s announcement trails an array of exits the Nigerian manufacturing sector has witnessed this year, with the most recent ones being major pharmaceuticals and FMCGs – GSK, Unilever, and Sanofi-Aventis. Challenging macroeconomic climate underpin these exits and point to worrying signs for the country’s already crippled manufacturing and industrial sector.

Industrial Market Occupier Analysis. Source: Estate Intel

Industrial Market Stock Breakdown by Sector. Source: Estate Intel

According to Estate Intel, FMCG and owner occupiers are among the largest drivers of industrial stock in Lagos, controlling 90% of the total stock. At the moment, P&G has only declared their intentions to cease ground operations and resort to an import-only model in Nigeria. No further information has been provided on their plans for their sole manufacturing plant in Oluyole Estate, Ibadan.

Estate Intel loves your feedback! Let the Insights team know what you think about P&G Leaving Nigeria by emailing [email protected].

Subscribe to ei Pro to access affordable real estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.