The African proptech space is one of the most undervalued markets in the world.

Tilda Mwai . 1 year ago

Share this post

Subscribe to our newsletter

Africa’s proptech scene in relation to the rest of the world is shocking, with the sector being one of the most undervalued in the world. This is according to Daniel Bloch, CEO SESO Global at a recent AMA event hosted by Estate Intel. Daniel noted that, “The property market in Africa is booming with…

Africa’s proptech scene in relation to the rest of the world is shocking, with the sector being one of the most undervalued in the world. This is according to Daniel Bloch, CEO SESO Global at a recent AMA event hosted by Estate Intel.

Daniel noted that, “The property market in Africa is booming with property prices in cities like Lagos and Accra being comparable to what we have in the US.” Research estimates that about 30% of all remittances to Nigeria and Ghana go into real-estate. This amounts to approximately $8 billion a year, with just a fraction of that currently flowing through proptech. In addition, he expects to see more foreign developers trying to enter the African space because of the decreasing population in Europe and some other developed nations. This is set to present a lot of opportunities in sales and transactions, construction management as well as financing due to lack of transparency in the market.

For example, SESO has seen an influx in foreigners moving to African countries like Ghana seeking to purchase property. However, access to credit has been a challenge. For example Banks in Nigeria have been forced to sit on their cash because they’re required by the CBN to have a Loan to Deposit ratio of 60% in order to avail financing. As such, SESO’s initiative has focused on building a diaspora mortgage product with interest rates of between 10 – 14%. In addition, they have also kicked off their first lease-to-own product in Lekki. This occurred as a result of construction financing availability to the developer resulting in a lease-to-own product for buyers with a 15 year payment plan.

However, Daniel noted that the journey is not as straightforward for proptech’s in Africa. Getting people to believe in the product and adopt it has been one of their major challenges. With people needing to recognize the brands. As such Seso has leveraged on influencer marketing and partnerships to help boost their reach, grow their network and increase trust in the product. He urged proptech to focus on the journey even as they focus on the end game.

He further noted that the biggest success in an early stage startup is to stay alive and keep going. Companies like EI & Spleet doing MetaProp, RentSmallSmall & Bungalow doing Techstars, puts more African proptech startups out there and gets investors interested. Collaborating and supporting each other, having conferences and events, such as the API events also helps startups grow. “Companies should always be in fund-raising mode. For every idea in the world, there’s someone out there who wants to invest in it, startup founders shouldn’t be afraid of pitching to everyone” Daniel concluded.

For these and more insights, you can join the next Open Property Africa AMA session by joining the group here.

Related News

You will find these interesting

Linah Amondi . May 2024

Last Friday, Africa’s leading outsourcing firm CCI Global, in the presence of Kenya’s President William Ruto inaugurated...

Eneo Tatu Central

Gateway Real Estate

Bisi Adedun . May 2024

The Hospitality Investment and Management Company (HIMC) has announced that it is accepting Expression of Interest submi...

Edo Hotel

Edo Radisson Hotel

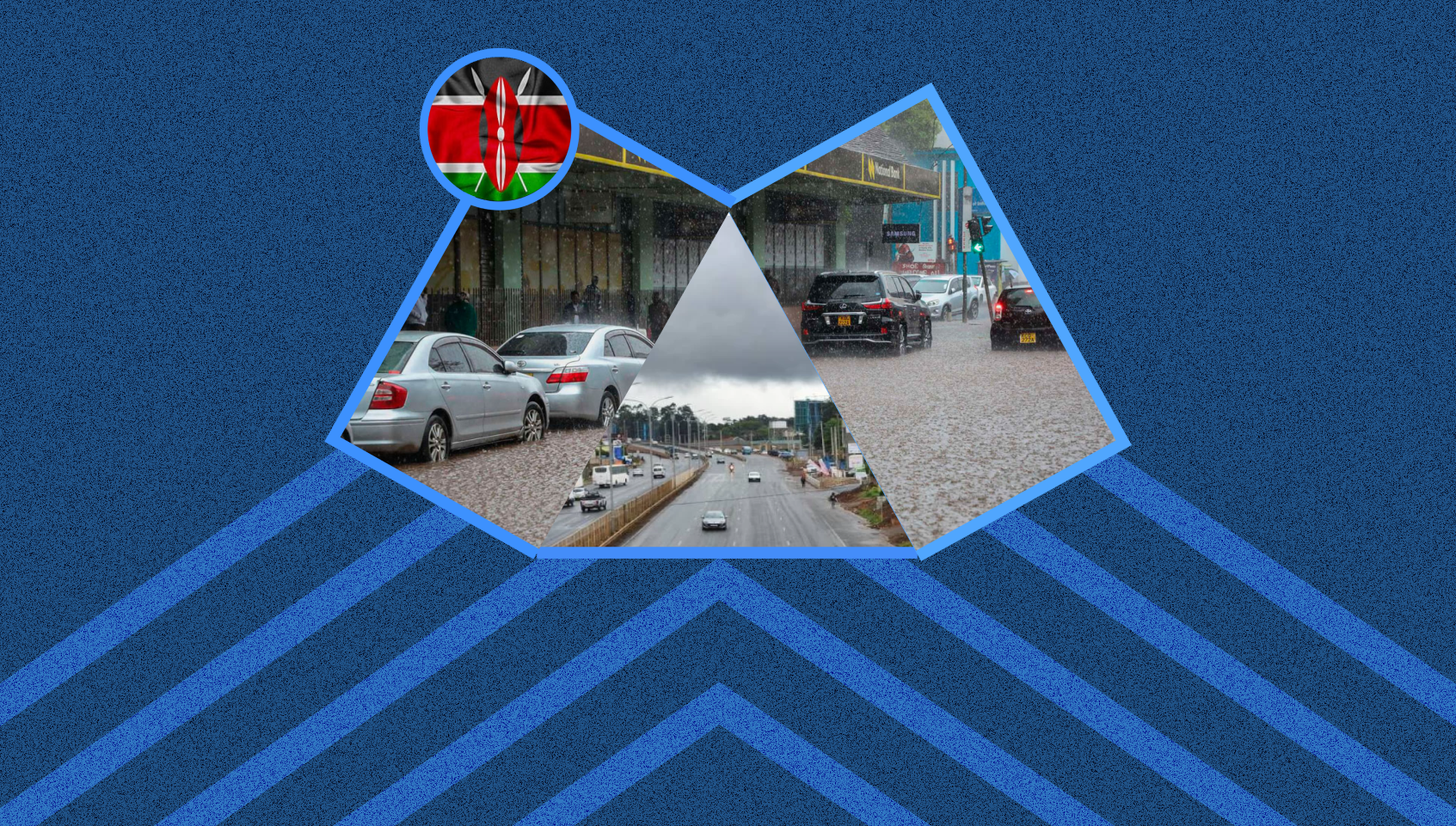

Linah Amondi . May 2024

Kenya is currently grappling with the impacts of one of its heaviest El Nino seasons in 18 years, with Nairobi and its e...

Nairobi

Nairobi Floods