Nigerian Real Estate & Construction Economic Sectors Sustain Quarterly Declines

Dolapo Omidire . 7 years ago

construction

economy

gdp

lagos

nbs

nigeria

premium

Share this post

Subscribe to our newsletter

Nigeria remained firmly in recession during Q3:2016 as data published by the Bureau of Statistics showed that the economy contracted -2.24%, a few basis points less than what was expected by most analysts. A worsening economic environment due to falling oil output and even more restricted access to USD led to the economy shrinking more than the…

Nigeria remained firmly in recession during Q3:2016 as data published by the Bureau of Statistics showed that the economy contracted -2.24%, a few basis points less than what was expected by most analysts. A worsening economic environment due to falling oil output and even more restricted access to USD led to the economy shrinking more than the -2.02% seen in the preceding quarter.

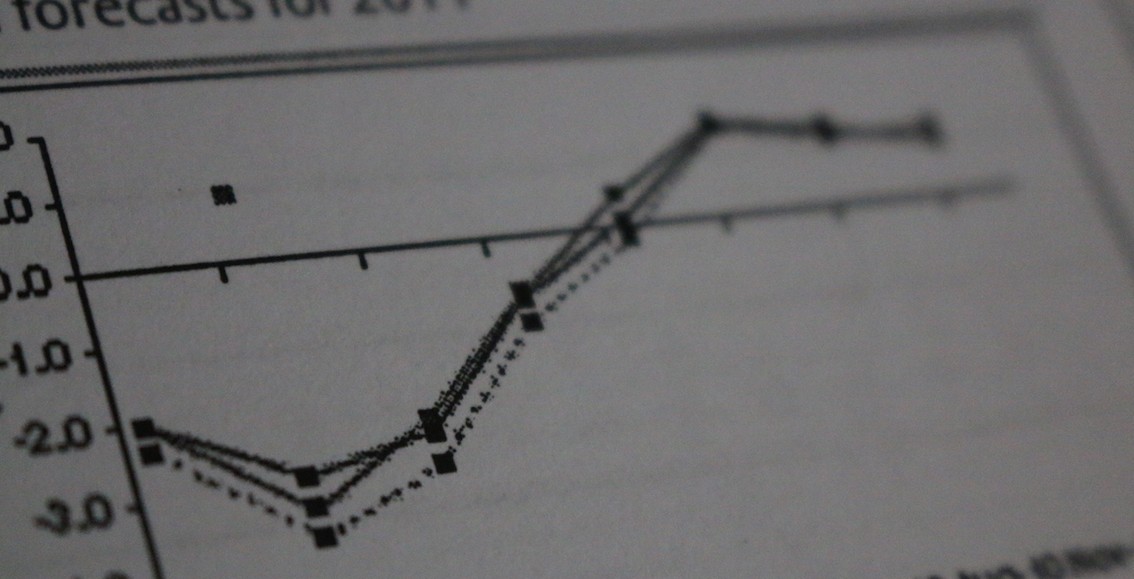

The real estate and construction sectors did not buck the trend either, growing at-7.37% and -6.13% respectively, a much poorer performance than the entire economy. As the graph below shows, the construction sector has been in free fall since last year, around when the Central Bank published a list of 41 items that were invalid for FX. Most of these items were real estate/construction sector related and this exacerbated an already slowing sector as most of the materials required for construction in Nigeria are typically imported.

Nigeria, Real Estate, Construction Quarterly GDP % Growth (Constant)

[visualizer id=”7532″]

Source: Nigerian Bureau of Statistics

Making things worse, restricted access to USD and increased all around costs have pushed inflation to 11 year highs at 18.33%. Coupled with negative GDP growth and increasing unemployment, a recipe for stagflation has been created.

In the institutional/commercial real estate space, multiple developments are preparing to or have broken ground over the past 3 quarters, especially in Victoria Island and Ikoyi. A few of these include the NDIC HQ, Centex Residential Development, Greystone Tower, VMP III, DSPDC development and the new Diamond Bank HQ among many others. This activity may be a result of developers and investors seeking to ensure that the rising cost of construction does not stop them from building already conceptualized projects that have secured funding. This is because if they do not begin building now, the rising costs could mean that the (not drawn down) funding secured to build, may be unable to complete it.