Here Are The Top Things To Watch Out For When Negotiating A Commercial Lease In Africa

Linah Amondi . 1 year ago

Commercial Lease

Lease Negotiation

Share this post

Subscribe to our newsletter

Article Summary: Negotiating a commercial lease across Africa can be a daunting task, especially if one does not have the necessary information and tips to conduct the process. It is therefore essential to conduct thorough due diligence on the prerequisites of negotiating the lease, in order to avoid misrepresentation and misinterpretation, and consequently get the best deal…

Negotiating a commercial lease across Africa can be a daunting task, especially if one does not have the necessary information and tips to conduct the process. It is therefore essential to conduct thorough due diligence on the prerequisites of negotiating the lease, in order to avoid misrepresentation and misinterpretation, and consequently get the best deal out of an agreement, backed up by well-informed decisions. This also mainly comes from having comparable data, which makes it easier to make decisions confidently. Notably, Estate Intel’s Lease Negotiation Toolkit was designed to help guide various individuals or entities in negotiating a lease, by providing in-depth market comparable transactions.

Below are some of the key factors to look out for when negotiating a lease in African cities:

- Lease Agreement Details Such As The Rental Terms, Period, And Flexibility:

Lease agreement details are generally terms and guidelines outlined in a tenancy agreement. They include:

- Rental Terms

For a lessee, the pricing points of a property are one of the most important factors when negotiating a lease because it also informs the choice of business premises. To calculate monthly chargeable rent, aggregate the total cost of all rent payments, and divide by the total contract term. Notably, there are various forms of rent in a lease which include but are not limited to:

- Gross Rent, where all outgoings are included in the rent. From the name, this is typically applicable under the gross lease type.

- Net Rent, where all outgoings are charged in addition to the rent. This type of rent is applicable under a net lease type.

- Turnover Rent: his type of rent is mostly applicable to retail tenants under a percentage lease type, and it is linked to the sales of a particular store. Precisely, it is a type of rent payable on top of the agreed fixed rate, i.e. 10% when a particular store exceeds the anticipated sales at any given month.

- Fit Out Rent, where the tenant pays back the landlord in return for fit-out expenses incurred on their behalf.

Most importantly, with rental rates and terms, it is essential to have knowledge of key property comparables, as a guide to making well-informed decisions.

- Escalation Points

Escalation clauses in a lease allow a landlord to increase the annual rents contrary to the agreed terms, based on various factors such as inflation. While there are no standard rates that all landlords across the continent use, in some African cities such as Lagos, this is set at 3%.

- Currency Of Payment

For African cities such as Lagos, the USD is the common mode of currency used in the majority of transactions. This is mainly a way for landlords to cushion themselves from potential fluctuating exchange rates from the different currencies in different countries. Conversely, for markets such as Kenya, local currency applies as a form of paying rent.

- Lease Period

While pricing points are key metrics in negotiating a lease, it is also important to understand the period of the lease and determine whether or not it serves one’s needs. In many cases, commercial leases in African cities are always capped at a maximum of three to five years, with the option to renew.

- Flexibility

As a lessee, it is crucial to check out for specific clauses and terms that enhance the flexibility of a lease, such as a ‘Break Clause’. Precisely, this allows the lessee to terminate a contract before the agreed term, due to unforeseen circumstances or in the event of a business outgrowing the premise hence an expansion is needed. Notably, the lessee has to give the lessor a notice period, as per the agreed terms in the contract.

Additionally, it is important to assess the option to sublet a space, particularly in a situation where one might or intends to sublease space. If the clause is not included, it is crucial to have an agreement with the lessor prior to signing the contract, in order to avoid disagreements in the future.

2. Incentives Such As Rent-Free Periods, Fit-Out Contributions, And Rent-Discounted Periods

For a lease, incentives are crucial in helping retain an existing tenant or motivate a potential new tenant into signing the agreement. The lease incentive is calculated by looking at the total value of the lease (rent x Net Leasable Area x lease term). A percentage discount is then applied to this value. Notably in a low vacancy rate property, incentives tend to be minimal, unlike a property with a high vacancy rate where landlords in many cases provide generous incentives to attract or retain the tenants. Some of the incentives to look out for include:

- Rent-Free Periods: From the name, it is a period whereby a tenant is exempted from paying rent. While it usually occurs at the beginning of a lease, there are instances within the lease period where it can apply, such as when a tenant is looking to move out having outgrown the space, or due to cash crunches emanating from economic factors, among other reasons.

- Rent-discounted periods: This is typically the reduction of a property’s rent for a specific period within the lease, while consequently helping the tenant reduce their operating expenses.

- Fit-out Contributions: This is a situation whereby the landlord makes a commercial tenant’s interior space suitable for occupation, especially for a tenant not able to generate funds quickly. For African cities, the fit-out costs can range between $800 per M2 to $1,150 per M2.

3. Building Specifications Such As Management, Fit-Out Guidelines, Existing Condition Of The Building, And Accessibility

To further understand where you intend to relocate or set up your business premises during negotiations, it is essential to look out for building specifications that align with the business needs. Key factors to look out for at this point include:

- Fit-out guidelines: This is to essentially help understand the requirements and processes required to undertake fit-out works, such as internal and external designs.

- Building Services: Ensure the provision of building services clauses in the lease, in order to avoid future problems such as inadequate drainage systems, inadequate IT infrastructure services, and inadequate power supplies, among other setbacks.

- Rules and regulations outlined in the tenancy agreement, in order to help maintain order at the premise

- Management: It is essential to have background knowledge of the property manager, owner, or landlord, in order to have confidence and create trust among the parties involved.

- Existing Condition Of The Building: This will inform one on whether to settle for a Grade A, B, or C building.

- Ample accessibility to amenities, utilities, and adequate infrastructure.

In conclusion, the most important factor while negotiating for a lease is to identify your needs and negotiate confidently through a well-informed decision, thus getting the best deal. Notably, this is only achievable through proper due diligence. Estate Intel’s Lease Negotiation Toolkit sets out these elements and provides actual market comparables to help guide your process. This is in order to avoid misinterpretations, misunderstandings, or misrepresentations, and consequently reduces potential risks that might be incurred post-signing a lease.

We love your feedback! Let us know what other factors to look out for when negotiating a lease by sending an email to insights@estateintel.com.

Subscribe to ei Pro to access affordable Real Estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.

Related News

You will find these interesting

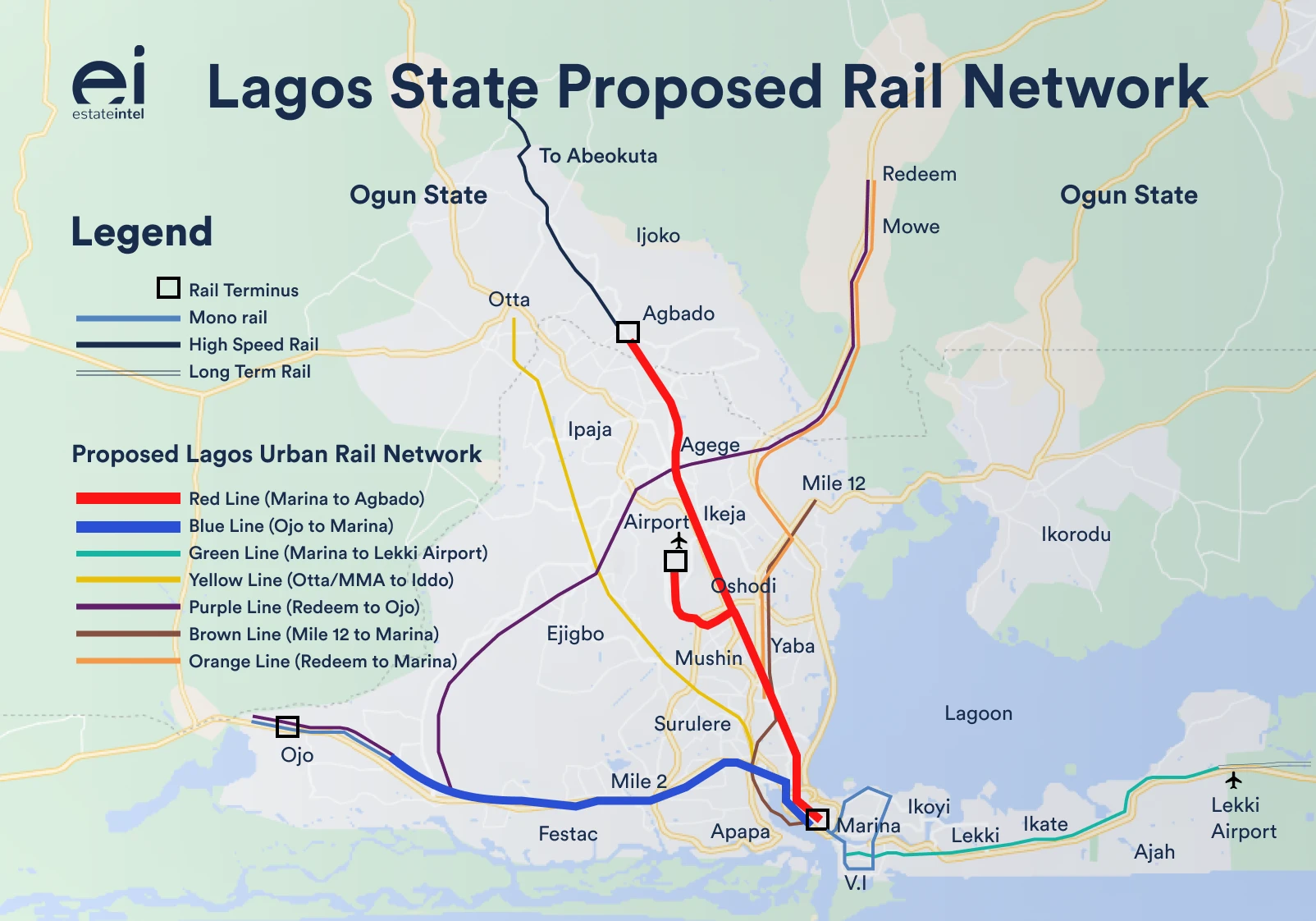

Bisi Adedun . September 2024

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc

Bisi Adedun . September 2024

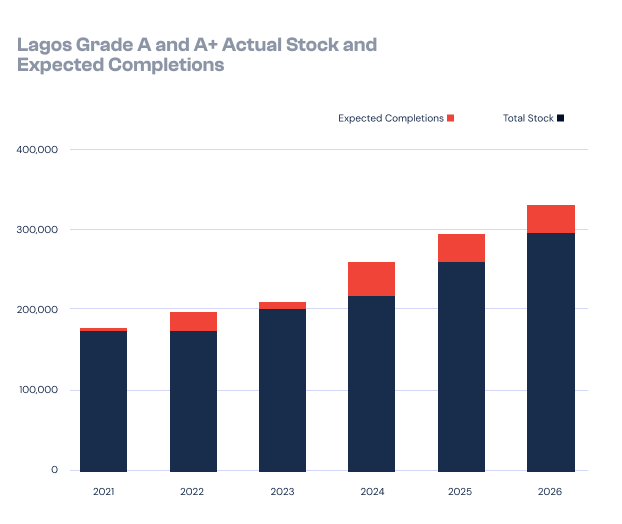

centre point tower

heritage place