How Kenya's Capital Gains Tax increase will impact on real estate

Tilda Mwai . 1 year ago

Share this post

Subscribe to our newsletter

Article Summary: In September 2022, the Kenya Finance Act of 2022 amended the Income Tax Act increasing capital gains tax from 5% to 15% effective from 1st January 2023. For context, capital gains tax is imposed on the seller of a property on the net gains on transfer of any property or stock in cases where the…

In September 2022, the Kenya Finance Act of 2022 amended the Income Tax Act increasing capital gains tax from 5% to 15% effective from 1st January 2023.

For context, capital gains tax is imposed on the seller of a property on the net gains on transfer of any property or stock in cases where the transfer value is 20% or more of the original value upon completion of a sale. It was reintroduced in 2015 at a rate of 5% upon suspension of almost 30 years in the country.

Interestingly, not all transactions are subject to the tax and some of the key exemptions include;

- Property (including investment shares) transmitted under inheritance.

- Sale of a deceased’s property for the purpose of administering the estate of the deceased provided the sale is completed within two (2) years of the death of the deceased.

- Compensation for land compulsorily acquired by the government for infrastructure development.

- Land transferred by an individual where the transfer value is less than KShs. 30,000

- Agricultural property that is less than 100 acres where the property is situated outside a municipality or gazetted township or urban area.

- Residential houses that are owner occupied for a period of three years preceding disposal.

- Gains on the transfer of property under a transaction involving recapitalisation, acquisition, amalgamation, dissolution or other similar restructuring of the corporate identity of a company that is found to be in the public interest.

In addition to the Capital Gains Tax, transfer of property in Kenya often incurs other costs including the Stamp Duty(levied on the property buyer at varying rates depending on the sale or lease amount. However, it is worth noting that President William Ruto announced plans to exempt all first-time home buyers from paying stamp duty, which was amended in 2020 to allow exemptions for first time home buyers of only approved affordable housing units by the government), any unpaid land rates and rent at the date of transaction as well as any arising professional fees such as the legal fees and agency fees.

Increased tax is set to leverage on rising land transactions

The increase in Capital Gains Tax is set to leverage on the rising property transactions contribution to economic growth. As at August 2022, total land transfers were recorded at 5,928 compared to 7,329 in 2021. The 2021 figure was a 5-year high from 3,948 transactions recorded in 2017.

Source: Ministry of Lands

The previous rate was relatively lower compared to other countries

Compared to other countries, Kenya ranked relatively low in its rate, with countries such as South Africa, Uganda and Senegal recording the highest rate in the region at approximately 45% and 30% respectively as illustrated in the figure below.

This arguably increased Kenya competitiveness as a preferred investment destination.

Source: Estate Intel Research

Increase in Capital Gains Tax may impact on Foreign Direct Investment (FDI) in the real estate sector

Independently, an increase in capital gains tax may not negatively impact real estate transactions in the country since Kenya’s rate of 15% is still relatively lower than regional peers. However, coupled with rising inflation and a depreciating currency and rising interest rates, the rate will likely dampen appetite for investment in property. So far, Kenya’s inflation rate was recorded at 9.1% in December 2022 from 5.4% in January same year.Similarly, the Kenya shilling exchanged at KES 123 against the dollar in December compared to KES 113 against the dollar in January.

As a result, associations such as the Kenya Property Developers Association and East African Venture Capital Association (EAVCA) had previously proposed an incremental approach to the tax hike instead of the one-off 200% increase.This was however not implemented and the 15% increase has now taken effect.

We love your feedback! Let us know what you think about the impact of the Capital Gains Tax on real estate in Kenya.

Related News

You will find these interesting

Linah Amondi . September 2024

In Estate Intel’s previous article, we highlighted Nairobi's top most sought-after prime residential areas, based on mon...

Avic International

Elegant Properties

Bisi Adedun . September 2024

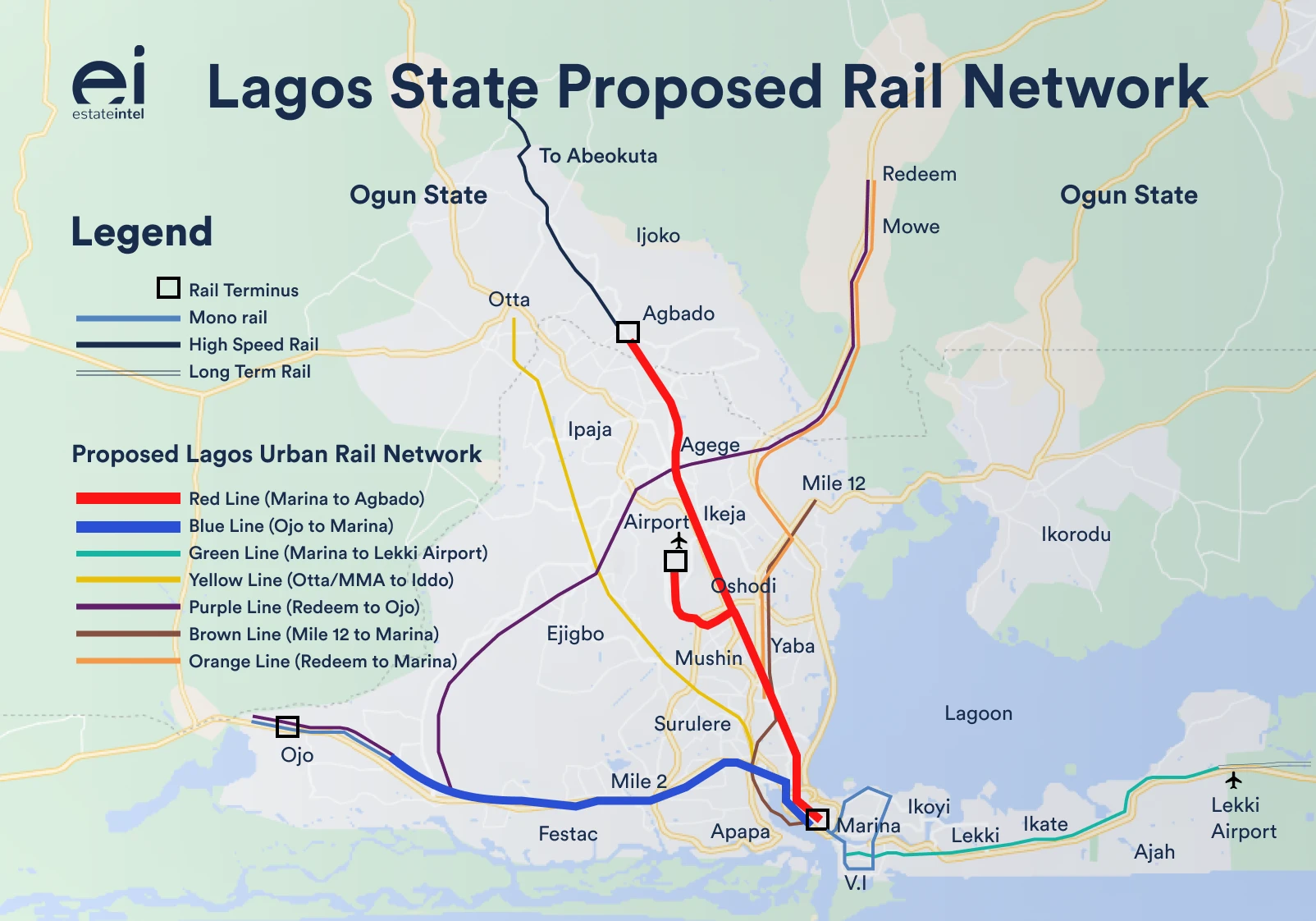

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc