FCMB Announces Partnership with Real Estate Firms on Affordable Housing

Bisi Adedun . 1 year ago

Share this post

Subscribe to our newsletter

Article Summary: FCMB, a leading financial institution in Nigeria, recently announced its partnership with Brains & Hammers Limited and Brooks Assets & Resources Limited to provide affordable housing for salary earners and self-employed residents of Lagos State. This collaboration between the banking giant and two real estate firms is part of FCMB’s commitment to promote financial…

FCMB, a leading financial institution in Nigeria, recently announced its partnership with Brains & Hammers Limited and Brooks Assets & Resources Limited to provide affordable housing for salary earners and self-employed residents of Lagos State.

This collaboration between the banking giant and two real estate firms is part of FCMB’s commitment to promote financial inclusion and economic growth in Nigeria. The initiative will provide mortgage loans of up to NGN 75 million to help individuals purchase homes or acquire land in areas of their choice within Lagos State, and also provide mortgaging services for those wishing to own their homes.

The partnership is expected to benefit both salary earners and self-employed citizens by providing a means to build or buy land and residential property. Anybody is eligible for the loan which offers a maximum repayment period of 120-months or a 10-year period. Additional benefits include:

- Loan access without additional collateral

- Insurance cover

- Flexibility to purchase fully completed residential buildings or land in any part of Lagos

Shamsideen Fashola, Divisional Head of Personal Banking at FCMB, buttressed the bank’s commitment to providing affordable housing options to its customers as well as other Nigerians seeking to become homeowners. He said “our partnership with Brains & Hammers Limited and Brooks Assets & Resources Limited provides a unique opportunity for our customers to fulfill their dreams of home ownership, easing all the constraints and fears associated with this exciting and self-fulfilling life moment that everyone cherishes”. Mr. Fashola said the FCMB mortgage loan is easy to obtain and repayment is flexible. He urged Nigerians to take advantage of the offer to fulfill their home ownership dream and assured them that, “FCMB will continue to support the dreams of its customers and Nigerians by giving them the financial support they need to be homeowners when it matters most”.

This initiative is one of many designed to bridge the housing deficit within the state currently estimated at 2.3 million households in our 2023 Lagos development pipeline report. Estate Intel currently tracks 7 projects under Brooks Assets & Resources located in Lagos while Brains and Hammers have 7 projects spread across Lagos and Abuja. Although mortgage adoption across the country has historically recorded low numbers, it’s a viable path to home ownership for the middle class. The success of this partnership could serve as an encouragement for Nigerians to explore this long-term option.

We love your feedback! Let us know what you think about FCMB’s affordable housing partnership with real estate firms by sending an email to insights@estateintel.com.

Subscribe to ei Pro to access affordable real estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.

Related News

You will find these interesting

Linah Amondi . September 2024

In Estate Intel’s previous article, we highlighted Nairobi's top most sought-after prime residential areas, based on mon...

Avic International

Elegant Properties

Bisi Adedun . September 2024

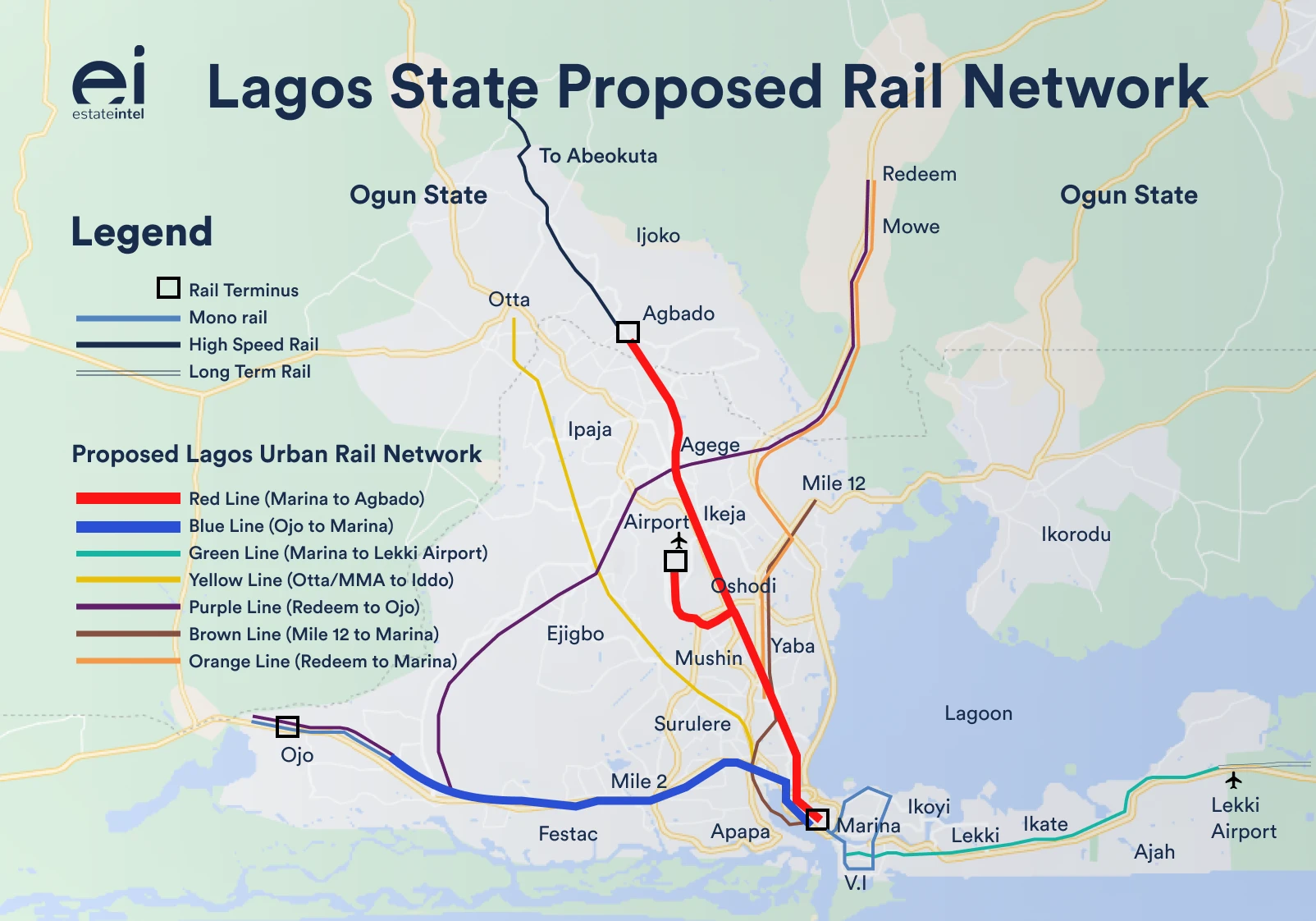

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc