Federal Mortgage Bank of Nigeria Launches Housing Estates in Lagos and Ogun state

Bisi Adedun . 1 year ago

Share this post

Subscribe to our newsletter

Article Summary: On Thursday, 4th of May, 2022, The Federal Mortgage Bank of Nigeria (FMBN) in collaboration with the Lagos State Development and Property Corporation (LSDPC) on Thursday announced the inauguration of a 72 units housing estate in Emuren, Sagamu, Ogun state. The estate, developed by LSDPC, comprises 48 units of two-bedroom terrace apartments and 24 units…

On Thursday, 4th of May, 2022, The Federal Mortgage Bank of Nigeria (FMBN) in collaboration with the Lagos State Development and Property Corporation (LSDPC) on Thursday announced the inauguration of a 72 units housing estate in Emuren, Sagamu, Ogun state. The estate, developed by LSDPC, comprises 48 units of two-bedroom terrace apartments and 24 units of three-bedroom semi-detached bungalows.

Furthermore, the next day, The Federal Mortgage Bank of Nigeria (FMBN) in collaboration with Cocoon Atlantic Housing Estate announced the inauguration of a 28-unit estate in Sangotedo, Lagos. So far, 8 beneficiaries have acquired units within the estate amidst plans to launch another estate nearby.

The completion of the estates, an initiative of the Federal Government to bridge the housing gap, was attributed to the bank’s Cooperative Housing Development Loan window which provides affordable housing access to contributors of the National Housing Fund (NHF) scheme. As a result, the beneficiaries of the scheme will have access to mortgage financing to meet the cost of the flats within both estates.

About the National Housing Fund’s Mortgage Loan Facility

The National Housing Fund (NHF) Mortgage Loan facility is granted at 4% interest rate to accredited Primary Mortgage Banks (PMBs) for on-lending at 6% to NHF contributors over a maximum tenure of 30 years, which is secured by the mortgaged property. To qualify for this facility, citizens have to:

- Be a Nigerian over the age of 21 years

- Be a contributor to the National Housing Fund for a minimum of 6 months

- Provide satisfactory evidence of regular flow of income to guarantee loan repayment.

Chairman of the Board of Directors of FMBN, Ayodeji Gbeleyi, on Thursday announced the increase of the mortgage loan limit from ₦15 million to ₦50 million. The loan can be accessed from the NHF through an accredited and licensed Primary Mortgage Bank as a mortgage loan to build, buy, improve or renovate one’s own home. However, no individual will be given a loan in excess of 90% of the cost or value of the property to be mortgaged.

The provision of mass housing has always been in the current government’s agenda who, in 2021, set a target of delivering 300,000 homes through the Nigerian Economic Sustainability Plan, which will not be met as at when the current government leaves office by May 29th. While the incentive behind the housing estates is sound, the mortgage loans offered by the NHF are notoriously difficult to acquire thus inhibiting the adoption of the facility as a means to homeownership for Nigerians interested. It will be interesting to see how the incoming administration restructures and consolidates the numerous housing agencies and the impact it will have on ongoing housing schemes and mortgage facilities like the National Housing Fund.

We love your feedback! Let us know what you think about Federal Mortgage Bank of Nigeria’s housing estate launch by sending an email to insights@estateintel.com.

Subscribe to ei Pro to access affordable real estate data such as; transaction comparables, sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.

Related News

You will find these interesting

Linah Amondi . September 2024

In Estate Intel’s previous article, we highlighted Nairobi's top most sought-after prime residential areas, based on mon...

Avic International

Elegant Properties

Bisi Adedun . September 2024

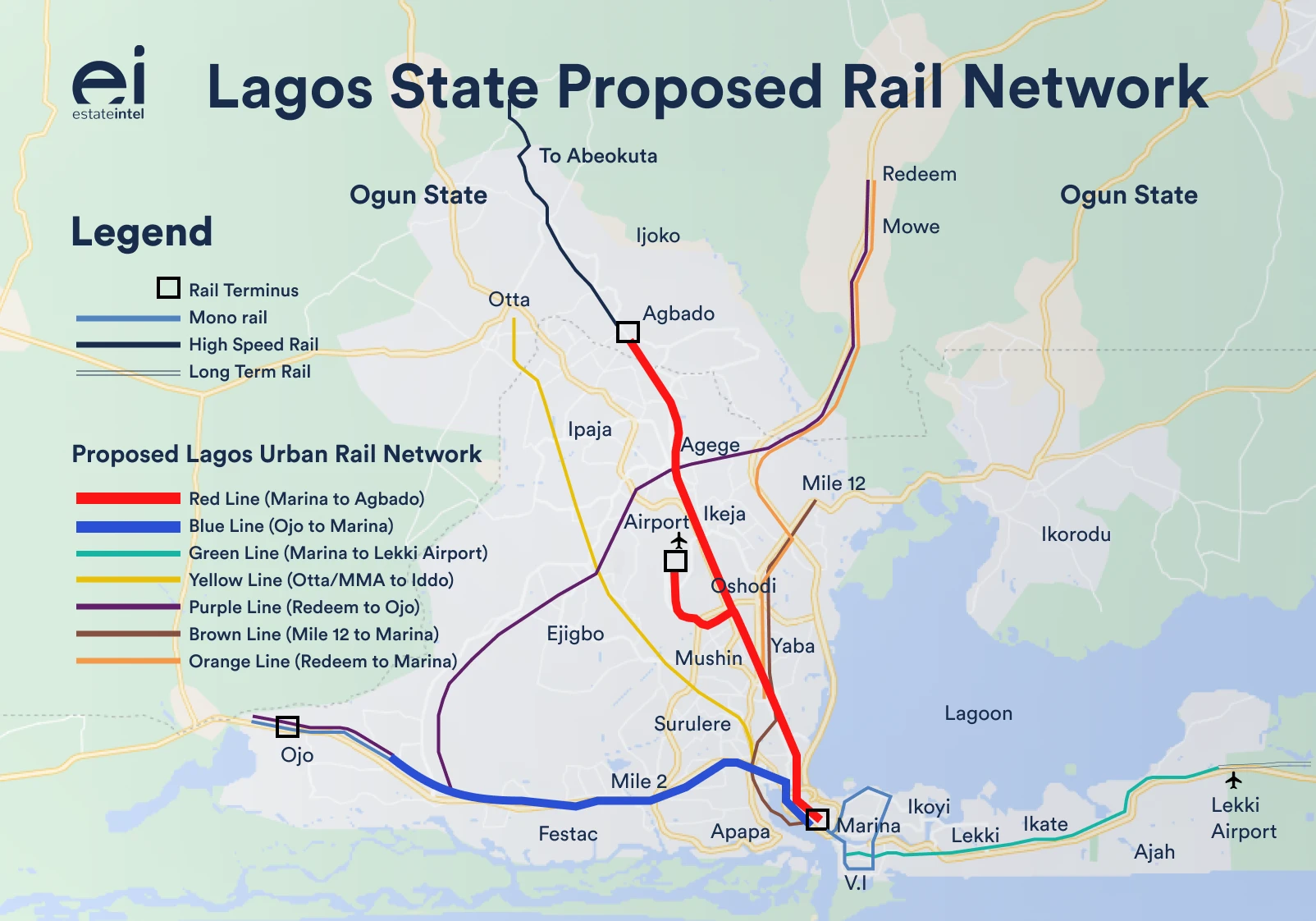

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc