Linzi Finco Trust To Float The First Ever Islamic Bond In Kenya, To Develop Affordable Housing Units

Linah Amondi . 11 months ago

Capital Markets Authority

Kenya Sukuk Bond

Linzi Finsco Trust

Share this post

Subscribe to our newsletter

Article Summary: Linzi Finsco Trust has received approval from the Capital Markets Authority of Kenya (CMA) to float the first ever Sukuk bond (islamic bond) in the country. Precisely, a sukuk bond differs from nominal bonds in that as a sharia-compliant bond, it prohibits interests but offers investors a share of the returns generated by the associated…

Linzi Finsco Trust has received approval from the Capital Markets Authority of Kenya (CMA) to float the first ever Sukuk bond (islamic bond) in the country. Precisely, a sukuk bond differs from nominal bonds in that as a sharia-compliant bond, it prohibits interests but offers investors a share of the returns generated by the associated tangible asset.

Linzi aims at raising Kshs 3.0 Bn ($20.4 Mn) under the Sukuk bond, which will be used to develop 3,069 affordable housing units, with an expected IRR of 11.3%. Conversely, the timeline to float the bond is yet to be disclosed. Nonetheless, the initiative’s timing could not have been any better as it aligns with the government’s affordable housing agenda of delivering 200,000 units annually.

According to the 2023 Nairobi Metropolitan Affordable Housing report, inadequate financing by both developers and end users has been a key setback in bridging Kenya’s housing gap currently standing at 2.0 Mn units and growing by 250,000 units p.a. As such, CMA’s step to approve Linzi’s bond issuance opens a new avenue of raising capital to supplement delivery of the housing initiative, while enhancing investments diversification.

Sukuk bonds are continuing to gain popularity in Africa while offering impressive returns to investors. Kenya’s step is thus remarkable as it joins other countries that have adopted the development financing instrument. Egypt, Morocco and Nigeria have for example issued and raised $1.5 Bn in February 2023, $116 Mn in 2018, and $130.2 Mn in December 2022, respectively according to Reuters and government body sites. Additionally, Algeria is also in the process of adopting the financing instrument, while KCB floated Tanzania’s first Sukuk bond last year.

We love your feedback! Let us know what you think about Kenya’s first Sukuk bond by emailing insights@estateintel.com.

Subscribe to ei Pro to access affordable Real Estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.

Related News

You will find these interesting

Linah Amondi . September 2024

In Estate Intel’s previous article, we highlighted Nairobi's top most sought-after prime residential areas, based on mon...

Avic International

Elegant Properties

Bisi Adedun . September 2024

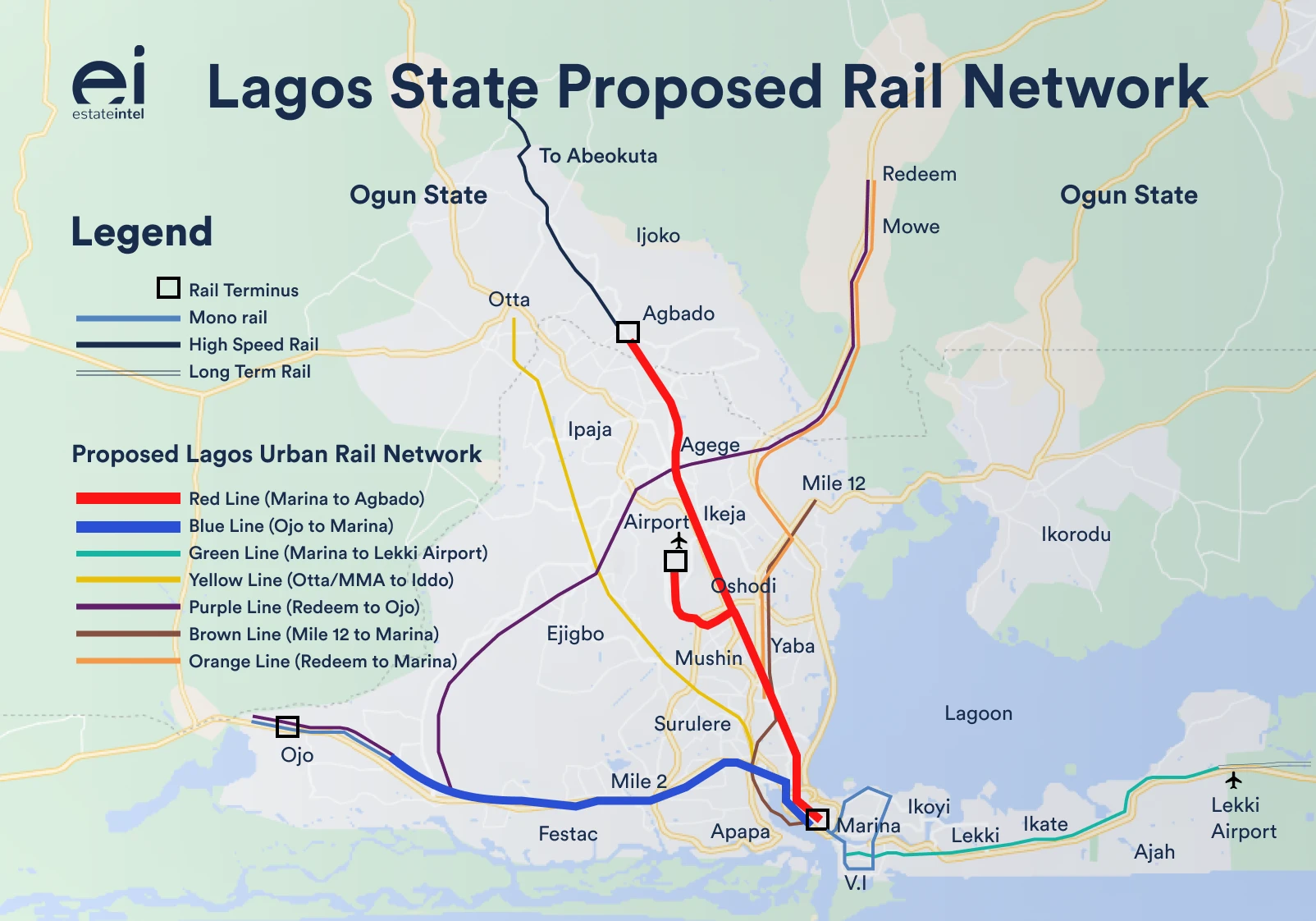

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc