Purple Announces The Opening Of Its Public Offer

Tilda Mwai . 1 year ago

Share this post

Subscribe to our newsletter

Article Summary: Lagos - 21 November 2022 - Purple Real Estate Income PLC ("PREIP" or "Purple"), Nigeria's breakthrough real estate investment platform, announces its Initial Public Offer opens today (21 November 2022). The Offer will be open for 25 working days, closing at midnight on 23 December 2022. This is the platform's first offering available to all…

Lagos – 21 November 2022 – Purple Real Estate Income PLC (“PREIP” or “Purple”), Nigeria’s breakthrough real estate investment platform, announces its Initial Public Offer opens today (21 November 2022). The Offer will be open for 25 working days, closing at midnight on 23 December 2022. This is the platform’s first offering available to all investors and following completion, Purple shares will be listed on the main market of the Nigerian Exchange (NGX), the regulated market managed by Nigerian Exchange Group.

Incorporated in 2014, Purple developed its flagship asset, PurpleMaryland (formerly known as the Maryland Mall), a market-shaping asset which opened its doors to customers in 2016 – introducing the largest outdoor LED screen in West Africa. Purple has five directly controlled subsidiaries: Maryland Mall Limited, Purple Proptech Limited, Lekki Retailtainment Limited, Cible Media Limited, and Purple Asset Managers Limited, with full ownership of all subsidiaries. In March 2022, by virtue of a Scheme of Merger, Purple merged with its subsidiary, PREDCO. Backed by prominent investors, Purple has recorded significant growth with current total assets in excess of ₦26.4 billion in FY2021.

From today the group is offering up to 2 billion new ordinary shares of the company via a public offer for sale. Purple intends to use the proceeds from the Offer to expand the group’s existing portfolio by diversifying its new lines of business and geographies to create more inclusive homeownership opportunities for Nigerians across the country.

The country’s real estate sector offers many prospects, particularly for consumers increasingly demanding all-inclusive living, blending high-quality lifestyle offerings with residential and commercial assets.

Purple is an integrated business delivering a new generation of real estate, property and lifestyle services to households and companies in Nigeria. Continuing this mission with PurpleLekki, the new construction will nurture tech-empowered communities and offer best-in-class entertainment, retail and hospitality with its experiential offering PurplePlay. Leveraging proptech, Purple creates a unique ecosystem of interconnected products offline and in the cloud, with the primary objective of building productive atmospheres that enable social and economic mobility.

Citadines, Purple’s new serviced apartment offering for occupiers, is part of a forward plan to build on its strong foundation to bring state-of-the-art homes, working infrastructure and purpose-built student accommodation to prime locations where there is an unmet need.

Commenting on the Offer launch, Laide Agboola, Chief Executive Officer, Purple, said: “Today is a significant step for the evolution of Nigeria’s real estate sector. By opening up participation in the real estate market to a new wave of Nigerian investors, Purple is delivering on our mission to democratise access to real estate in Nigeria. Additionally, by delivering on an expanded pipeline of new projects in a range of asset classes, we are providing new investment opportunities focused on stabilised, income-generating properties that respond to the fundamental changes to how communities in Nigeria want to work, consume and live.

In line with Purple’s ambition to provide retail investors with technology-enabled access to real estate as an asset class, we have made available the initial public Offer online – http://purple.xyz/invest, while also making it available through our network of issuing houses and banks. We want every Nigerian to have the opportunity to participate as Nigeria’s real estate sector evolves.”

Offer details

The Offer will be conducted through:

- Listing: The New Ordinary Shares will be listed on NGX under a new ticket symbol to be advised.

- Offer Size: ₦10 billion Equity Offer representing an IPO of 2,000,000,000 Ordinary Shares at N5 per share.

- Availability: The Offer will be available during the Validity Period which runs from 21 November 2022 to 23 December 2022.

- Method of Issue: Under the Offer, New Ordinary Shares will be sold via an Initial Public Offer (IPO); as approved by the SEC.

- Use of Proceeds: The net proceeds of the Offer will be disbursed to the Company for the purpose of debt refinancing, development of Lekki Retailtainment, cost of Issue refinancing and to meet working capital needs whilst positioning Purple for the acquisition of income-producing real estate such as Mansard Place amongst others.

The Process

The Offer will be open from midnight on 21 November. The Offer will close at midnight on 23 December. Interested investors can find full details of how to place orders and subscribe for shares as well as answers to a wide range of questions at http://purple.xyz/invest

Applying for Shares

Interested investors should use the approved channels listed below to place orders and subscribe for shares. You can find full detailed information at http://purple.xyz/invest or consult with your stockbroker or banker for further guidance.

- Investor proposition and all documents can be gotten from – http://purple.xyz/invest

- Investors can apply via the app platform: http://invest.purple.xyz

Receiving Agents: To submit an application for shares through the receiving agents – issuing houses and stockbrokers and banks, investors will need to:

- Complete an application form;

- Submit the completed application form and evidence of payment to a Receiving Agent;

- For Banks, an application can be completed at the bank branches nationwide and payments processed at the same bank branch. Stanbic IBTC Bank Plc and First Bank of Nigeria Plc are receiving banks to the Offer.

A Bank Verification Number (BVN) is required to register and investors will need to have a CSCS account number to complete the transaction. If you do not have a CSCS account, your stockbroker can assist in setting one up for you, before completing your application. A CSCS account can also be created for you as part of the application process.

Issuing houses, stockbrokers, registrars and receiving banks

Transaction advisors who can assist with your application are as follows:

-

- Lead Issuing House: Emerging Africa Group

- Joint Stockbrokers to the Offer: CardinalStone Securities Limited, FBNQuest Securities Limited, and Stanbic IBTC Stockbrokers Limited

- Registrars: CardinalStone Registrars Limited

- Receiving Banks: FirstBank, Jaiz Bank, and Stanbic IBTC Bank

Receiving Agents

A full directory of receiving agents registered and authorised by the Securities & Exchange Commission to receive your applications are as follows:

Banks

| Access Bank PLC

Citibank Nigeria Limited Coronation Merchant Bank Limited Ecobank Nigeria PLC FBNQuest Merchant Bank Limited Fidelity Bank PLC |

First Bank of Nigeria Limited

First City Monument Bank Limited FSDH Merchant Bank Limited Guaranty Trust Bank PLC Heritage Bank PLC Jaiz Bank PLC Keystone Bank Limited |

Nova Merchant Bank

Polaris Bank Limited Providus Bank PLC Rand Merchant Bank Nigeria Limited Stanbic IBTC Bank PLC Standard Chartered Bank Nigeria Limited |

Sterling Bank PLC

Suntrust Bank PLC Union Bank of Nigeria PLC United Bank for Africa PLC Unity Bank PLC Wema Bank PLC Zenith Bank PLC |

Stockbrokers and others

| Absa Securities Nigeria Limited

Afrinvest Securities Limited Anchoria Investment and Securities Limited Apel Asset Limited APT Securities & Funds Limited ARM Securities Limited Arthur Stevens Asset Management Limited Associated Asset Managers Limited Atlass Portfolio Limited Ava Securities Limited Bancorp Securities Limited Bauchi Investment Corp. Securities Limited Belfry Investment & Securities Limited Bestworth Assets & Trust Limited Calyx Securities Limited Camry Securities Limited Capital Assets Limited Capital Express Securities Limited Capital Trust Brokers Limited CardinalStone Securities Limited Cashville Investments & Securities Limited CDL Capital Markets Limited Centre Point Investment Limited Century Securities Limited Chapel Hill Denham Securities Limited Chapel Hill Denham Advisory Limited Chartwell Securities Limited Citi Investment Capital Limited City Code Trust & Invest Company Limited Compass Investments & Securities Limited Cordros Securities Limited Core Securities Limited Coronation Securities Limited Cowry Securities Limited Crossworld Securities Limited Crown Capital Limited CSL Stockbrokers Limited Deep Trust & Investment Limited De-Lords Securities Limited Dominion Trust Limited DSU Brokerage Services Limited Dunbell Securities Limited Dunn Loren Merrifield Securities Limited Dynamic Portfolio Limited EDC Securities Limited Edgefield Capital Management Limited |

EFG Hermes Nigeria Limited

El-Elyon Alliance & Securities Limited Elixir Securities Limited Enterprise Stockbrokers Limited Equity Capital Solutions Limited Eurocomm Securities Limited Express Portfolio Services Limited Falcon Securities Limited FBC Trust & Securities Limited FBNQuest Securities Limited FCSL Asset Management Co. Limited Financial Trust Company Nig. Limited Finmal Finance Services Limited First Integrated Capital Mgt. Limited FIS Securities Limited Foresight Securities & Inv. Ltd Forthright Securities & Inv. Limited Fortress Capital Limited FSDH Capital Limited FSL Securities Limited Funds Matrix & Asset Mgt. Limited Fundvine Capital & Securities Limited Futureview Securities Limited GDL Stockbrokers Limited Gem Assets Management Limited Gidauniya Invest & Sec Limited Global Asset Mgt. (Nig) Limited Globalview Capital Limited Golden Securities Limited Greenwich Securities Limited Gruene Capital Limited GTI Securities Limited Harmony Inv. & Securities Limited Heartbeat Investments Limited Hedge Securities & Investment Limited Heritage Capital Markets Limited ICMG Securities Limited Icon Stockbrokers Limited Imperial Assets Managers Limited Integrated Trust & Investments Limited Interstate Securities Limited Investment One Stockbrokers Int’l Ltd Investors & Trust Company Limited Kapital Care Trust & Securities Limited Kedari Capital Limited Kinley Securities Limited Kofana Securities & Investment Limited |

Lambeth Capital

Lead Securities & Investment Limited Lighthouse Capital Limited Magnartis Finance & Inv. Limited Marimpex Finance & Inv. Co. Limited Maxifund Investment & Securities PLC MBC Securities Limited Mega Equities Limited Meristem Stockbrokers Limited Mission Securities Limited Molten Trust Limited Morgan Capital Securities Limited Mountain Investment & Securities Limited Network Capital Limited Networth Securities & Finance Limited Newdevco Investment & Securities Limited Nigerian International Securities Limited Nigerian Stockbrokers Limited Norrenberger Securities Limited Novambl Securities Limited Osbourne Capital Markets Limited PAC Securities Limited Parthian Securities Limited Peace Capital Markets Limited Pilot Securities Limited Pinefields Investment Service Limited PIPC Securities Limited Pivot Capital Limited Planet Capital Limited Portfolio Advisers Limited Premium Capital and Stockbrokers Limited Primewealth Capital Limited Prominent Securities Limited PSI Securities Limited Purple Asset Managers Limited Pyramid Securities Limited Qualinvest Capital Limited Quantum Zenith Securities & Inv. Limited Rainbow Securities Limited Rand Merchant Bank Nigeria Limited Readings Investment Limited Regency Assets Management Limited Renaissance Securities (Nigeria) Limited Rencap Securities (Nig) Limited Resort Securities Limited Reward Investment & Service Limited |

RMB Nigeria Stockbrokers Limited

Rostrum Investment Rowet Capital Management Limited Royal Crest Finance Limited Royal Guaranty & Trust Limited Sankore Securities Limited Santrust Securities Limited Securities & Capital Mgt. Co. Limited Securities Africa Financial Limited Security Swap Limited Shalom Inv. & Securities Limited Shelong Investment Limited Sigma Securities Limited Signet Investment & Securities Limited Skyview Capital Limited SMADAC Securities Limited Solid-Rock Securities & Investment PLC Spring Board Trust & Inv. Limited Spring Trust & Securities Limited Stanbic IBTC Capital Limited Stanbic IBTC Stockbrokers Limited Standard Union Securities Limited StoneX Financial Nigeria Limited The Bridge Securities Limited Tiddo Securities Limited Tomil Trust Limited Topmost Securities Limited Tower Securities & Inv. Co. Limited Trade Link Securities Limited Traders Trust & Inv. Co. Limited Transworld Inv. & Securities Limited Trust Yields Securities Limited Trustbanc Capital Mgt. Limited Trusthouse Investment Limited TRW Stockbrokers Limited Tyndale Securities Limited UCML Capital Markets Limited UIDC Securities Limited UNEX Capital Limited United Capital Securities Limited Valmon Securities Limited Valueline Securities & Inv. Limited Vetiva Capital Management Limited Vetiva Securities Limited . WCM Capital Limited WSTC Securities Zion Stockbrokers & Securities Ltd |

About Purple

Purple is Nigeria’s breakthrough real estate and financial services platform at the forefront of a real estate revolution. With investments in the development, management, and acquisition of superior multi-purpose properties and infrastructure across a wide range of sectors to democratise access to real estate ownership and investment, Purple is breaking down the barriers that prevent investors from the gains of appreciating assets.

PREIP commenced operations in 2014 and is responsible for developing the Maryland Mall, a Grade-A mixed-use centre that also boasts the largest outdoor LED screen in West Africa.

To discover more and join the Purple community, visit purple.xyz

For investor inquiries, please contact:

Investor Relations

investors@purple.xyz

Olayinka Sodipe

Oluyemisi Lanre-Phillips

purple@vaerdi.org

For media inquiries, please contact:

Emmanuel Balogun

ebalogun@africapractice.com

Follow Purple on

Facebook: Purple

Instagram:@Purplegroupng

LinkedIn: Purple Group NG

Twitter: @Purplegroup_ng

Related News

You will find these interesting

Linah Amondi . September 2024

In Estate Intel’s previous article, we highlighted Nairobi's top most sought-after prime residential areas, based on mon...

Avic International

Elegant Properties

Bisi Adedun . September 2024

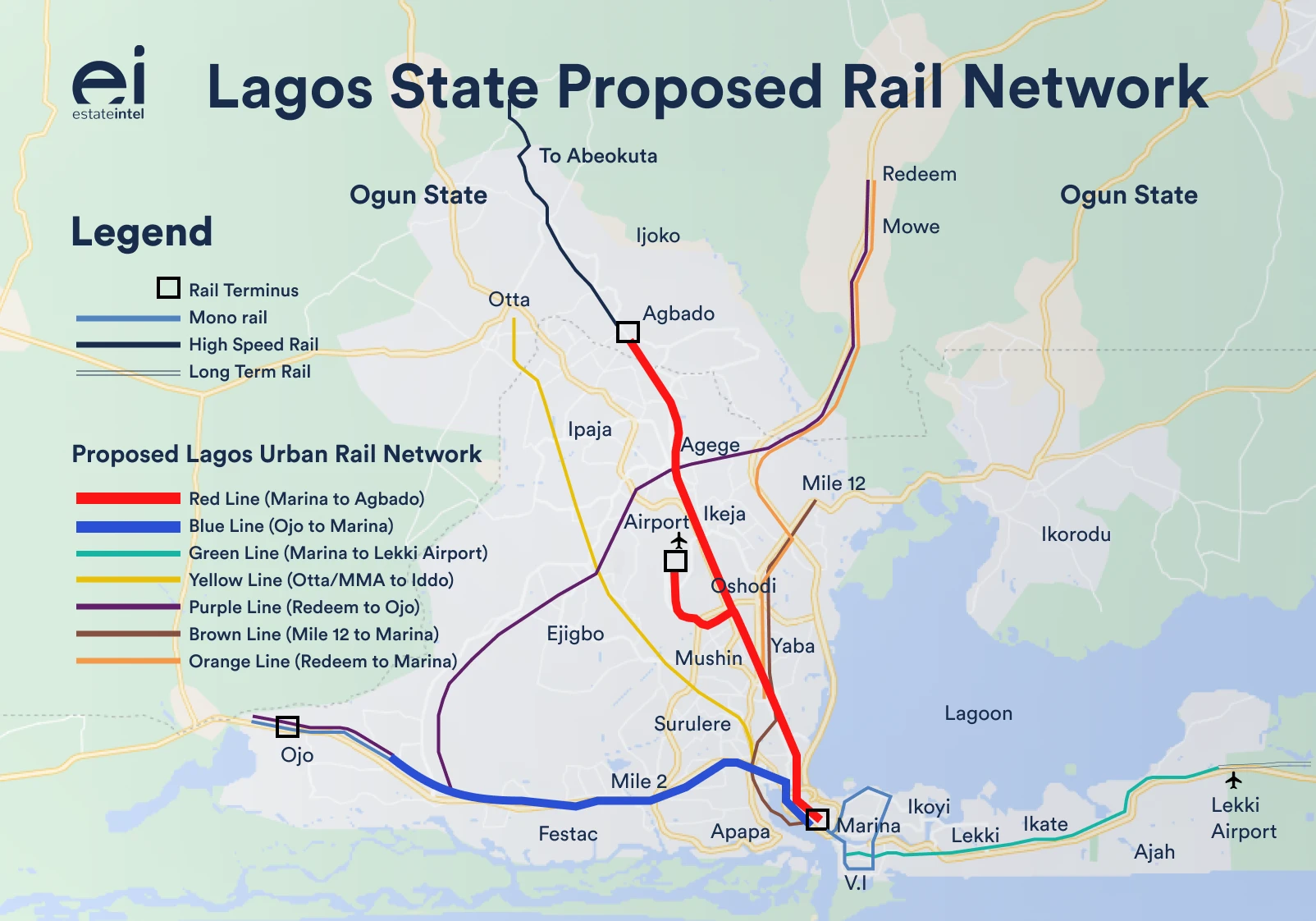

Lagos blue line

lagos green line

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc