Over 700 luxury apartments coming to Lagos by 2027, who’s buying?

Dolapo Omidire . 8 months ago

belmonte prive

cuddle by cadwell

lagos real estate

Lagos residential market

no. 4 bourdillon

Share this post

Subscribe to our newsletter

Article Summary: New research from Estate Intel shows that up to 753 apartments with price tags of $ 1 million or more are currently under construction in Lagos. It has led to a consistent question - why are developers building, who’s buying, and how will the units be absorbed?

New research from Estate Intel shows that up to 753 apartments with price tags of $ 1 million or more are currently under construction in Lagos. Most of these units will be located on the B.A.G Stretch in Old Ikoyi, Eko Atlantic, Victoria Island, and Banana Island with asking prices going up to $6m.

While many have been conceptual for a few years, in the past 12 months alone, the number of them that have converted to real development starts represents a 33% increase to the status quo. It’s not slowing down either. New luxury and ultra-luxury mega-projects across the pricing spectrum are being announced monthly, each with completion dates slated for 2026/2027.

It has led to a consistent question – why are developers building, who’s buying, and how will the units be absorbed? This is an ongoing internal discussion among Estate Intel’s analysts, with our real estate investing clients looking to remain competitive in a high-supply environment, and curious bystanders struggling to understand how it all makes sense. The short answer to the absorption question is that the city will not be able to absorb all the apartments, not without some price adjustments. Nonetheless, here are (just a few) of our thoughts on the topic.

Before you start, use the map below to get acquainted with a handful of the projects. A few of those we enjoy looking at include 4 Bourdillon’s sequel, 39 Bourdillon, La Serena on Kofo Abayomi (Queens) Drive before the cladding, 4 Seasons Hotel & Apartments (on hold) on Osbourne Road, and Metropolitan Tower on Ozumba Mbadiwe Avenue (we’re in love with the floor plans). There are so many more.

Source: Estate Intel

WHY ARE THEY BUILDING?

The 4 Bourdillon Milestone and the Importance of Timing

The completion and success of 4 Bourdillon is an important milestone in this story. While other projects such as Ultimate Apartments or Rebecca Court (back in the day), redefined the city’s standard of luxury housing when they were completed, no other property has so easily become the reference for ultra-luxury quite like how 4 Bourdillon has. Though the property has shortcomings, it proved what can be achieved to market players, and has given them the courage to attempt it. Especially because the $1-$3m (average) apartments were sold out before its completion in 2020.

Given the limited demand, we expect that timing, or more accurately, speed to market, will be one of the more important success factors for these projects in the pipeline. For example, even though the Belmonte PRIV did not have a well-known contractor, an important selling point for savvy luxury property buyers, their speed to market meant that they could compete with 4 Bourdillon and Cuddle by Cadwell, which were still under construction. However, in an environment where speed is crucial to success, project sponsors and buyers must be cautious to ensure that building integrity and structural confidence are not compromised.

The market is not performing as badly as most people think, for now at least.

The consistent narrative for luxury apartments in Lagos is that ‘all of the apartments in Ikoyi are empty’ or ‘they just built it and left it there’. While this has been true for some of the time, it certainly is not the truth all of the time. As we put in a 2020 note: ‘Most luxury developers [typically] seek to ‘redefine the existing standard of luxury in Lagos’. In reality, this is not usually the case, as their projects usually only have location as their asset. They usually lack the generous apartment sizes, high-quality finishing and the full suite of amenities and facilities required to demand a luxury rental rate or sale price. The result is a market segment left with an unusually high number of low-spec apartments with high and inflexible pricing.’ This can be worsened where they were developed using ‘cash’, meaning there is no pressure to sell or lease it out.

During Q1:2024, however, we recorded strong average occupancy rates in all well-built properties that we classify as luxury and ultra-luxury in Old Ikoyi and Victoria Island, and it is strengthening. Even with annual rentals north of $80,000, empty units in other well-built properties do not typically stay on the market for more than 4 – 6 weeks.

Speaking on current market performance, David Mbah, Partner at MDS Properties explained:

“Luxury developments in these areas are generally faring well. Demand is growing and supply even more. Occupancy levels are way better than in the last 24-36 months.”

Leye Taiwo, Managing Director at Swindon Property agreed, when speaking with Estate Intel, he explained:

“Having tracked absorption rates across the prime residential market for over 10 years, we would say that the current occupancy rate of 97% suggests that there is an insatiable demand for prime residential with huge increments on the median sale and lease pricing over the same period. However, the current pipeline which represents circa 30% of the current existing stock, suggests that the supply-demand dynamics are likely to change over the next few years as more buildings are delivered. This is most likely going to lead to a price adjustment.”

‘Cash Available’ is a better indicator of success than Occupancy Levels [Apparently]

As Estate Intel pointed out in this case study on UPDC’s REIT portfolio, residential yields are low compared to other sectors, usually ranging between 5-6% on average. This means developers typically aim to sell to make healthier profits. They sell to owner-occupiers or buy-to-let investors who then take on rental risk. As such, the presence of ‘empty apartments on Bourdillon’ or high vacancy rates is not usually a primary deterrent to developers, as that does not affect them in the way one might expect. Luxury property developers in Lagos are more concerned about the size of HNI pockets or the amount of cash in circulation because history has shown that regardless of vacancy levels, there are always individuals in Nigeria willing to buy luxury apartments.

WHO IS BUYING?

As usual, we’ll try to bring in some hard facts, specifically an I.D. on the total addressable market. How many people can afford it? We can split them into 3 broad segments, local HNIs, institutional investors and diaspora buyers.

Local HNIs

Research from Henley & Partners – New World Wealth in 2024, publishers of the respected Africa Wealth Report states that there are over 8,200 Nigerians with private wealth of $1m, 23 with over $100m, and just 3 with over $1bn. These numbers have dwindled over the years as the Naira devalued against the US Dollar. Using their 2022 report as a proxy, the estimate for those with over $10m in 2024 is 418 Nigerians, which we have used as the entry point for those buying an apartment worth $1m – $6m. This data almost always leads to an accuracy debate, find out more about their methodology here.

Source: Africa Wealth Report

Institutional Investors

Other parts of the market size include institutional investors such as closed pension funds, oil and gas companies, and some cooperatives who sparingly purchase apartments for investment or utility. In this space we have c. 50 that can buy an average of 5 – 10 apartments each, using the upper limit gives us an additional c. 500 units.

Diaspora buyers

This is an important category and a major driver for all residential sales across the country. While there are active participants in the ‘million dollar home’ space, buyers in the diaspora are more active with middle-income and deluxe properties, where prices range between $40,000 and $400,000.

Even though it’s clear that there is a market of potential wealthy buyers, the baseline facts do not chart a path for these units to be effectively absorbed. Especially if it may require the total addressable market to buy an apartment within the next 3 years. As with any global city, however, there are always ‘unspoken market drivers’. Estate Intel, however, prefers not to comment on that which cannot be accurately quantified. We will, however, acknowledge its existence and relevance in the success of many of these projects.

HOW WILL THEY BE ABSORBED?

Akin to the easily predicted dip in office rents during 2016/2017, which was a result of a massive increase in total stock that was worsened by the recession, we expect prices of apartments to soften in the years ahead as these projects rush to completion and compete against each other. We expect the biggest price dip during 2026 and 2027. In a higher supply environment, project sponsors with a track record will have the upper hand but many other factors must be considered. Nonetheless, you will be spoilt for choice if you want to buy a luxury apartment in the next few years.

These are, of course, a summary of casual thoughts and musings from the Insights team at Estate Intel and I. If you are looking for more definitive and structured guidance on where to purchase; how to stay ahead of the market as a developer; or a vendor in need of details of all these projects, our research team ([email protected]) is on standby to provide more real estate analysis and reports. We are waiting to hear from you.

As always, we love your feedback! Join the conversation on Instagram and LinkedIn and let us know what you think about the luxury apartments in Lagos currently under construction.

Related News

You will find these interesting

Bisi Adedun . September 2024

Lagos State Government Signs MoU for Key Infrastructure Projects: Lagos Green Line and Lekki-Epe Bridge

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc

Bisi Adedun . September 2024

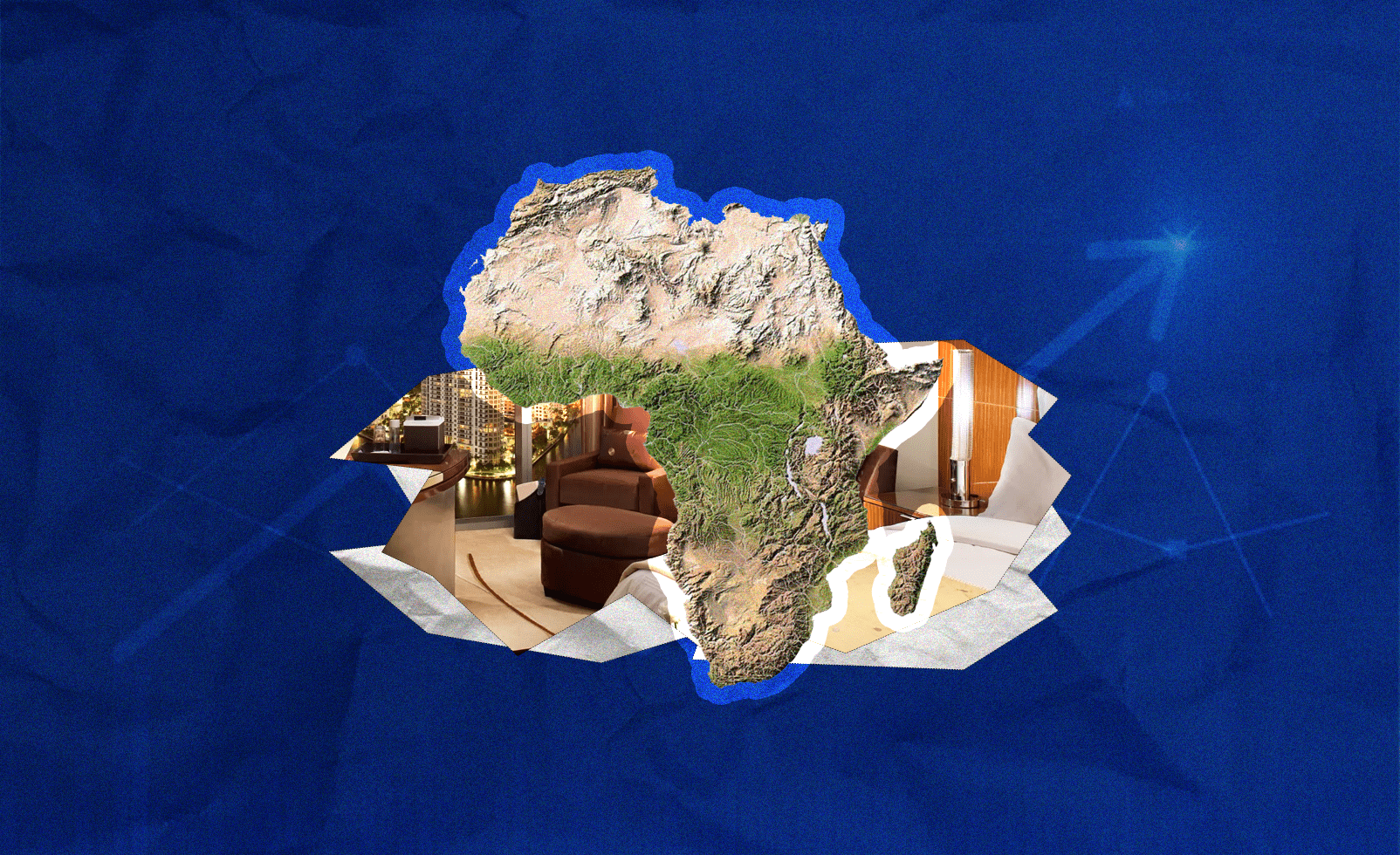

The Lagos hospitality sector continues to outperform market expectations

The Lagos hospitality industry continues to exhibit healthy performance in terms of RevPAR and Average Daily Rates drive...

2024 lagos real estate report

black diamond hotel

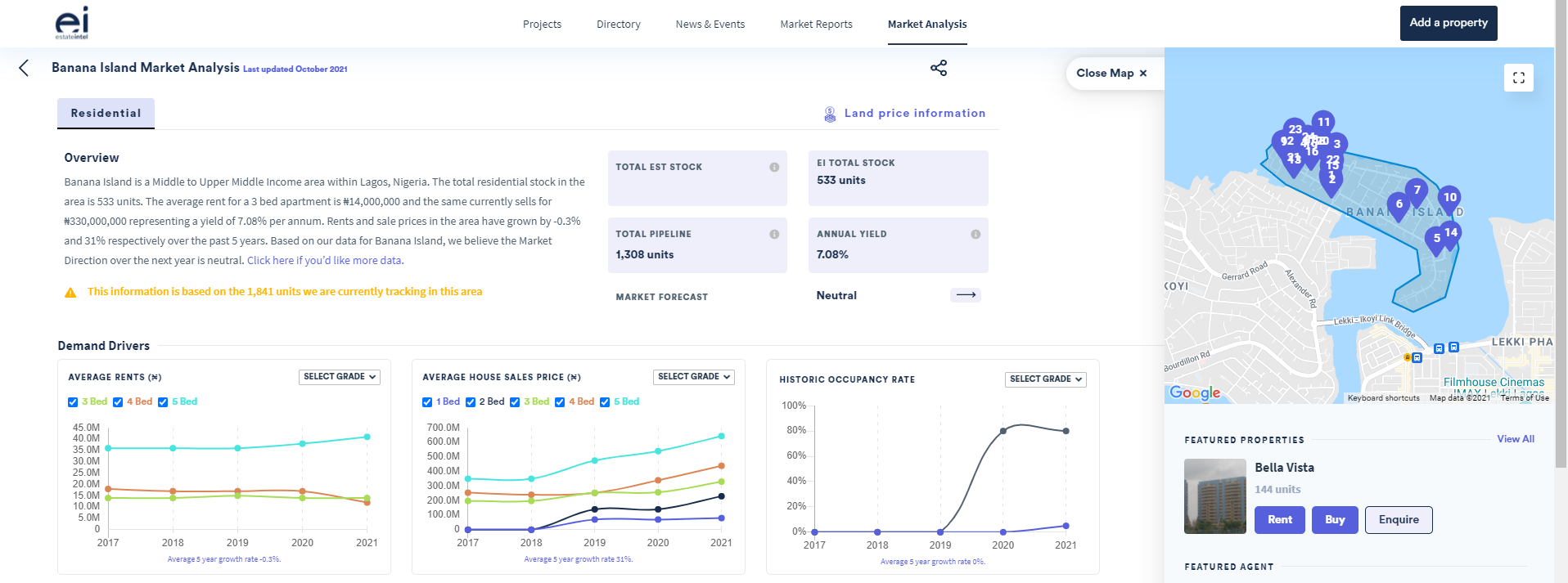

Research . October 2021

Devaluation, surging land prices etc., is driving artificial residential yields in the highbrow Banana Island (2021)

banana island

Chagoury Group