The Lagos hospitality sector continues to outperform market expectations

Bisi Adedun . 2 weeks ago

2024 lagos real estate report

black diamond hotel

delborough lagos

lagos hospitality market

lagos real estate

lagos real estate report

Nigeria Real Estate

Share this post

Subscribe to our newsletter

Article Summary: The Lagos hospitality industry continues to exhibit healthy performance in terms of RevPAR and Average Daily Rates driven by business and leisure activities in Nigeria’s economic powerhouse. Here's why.

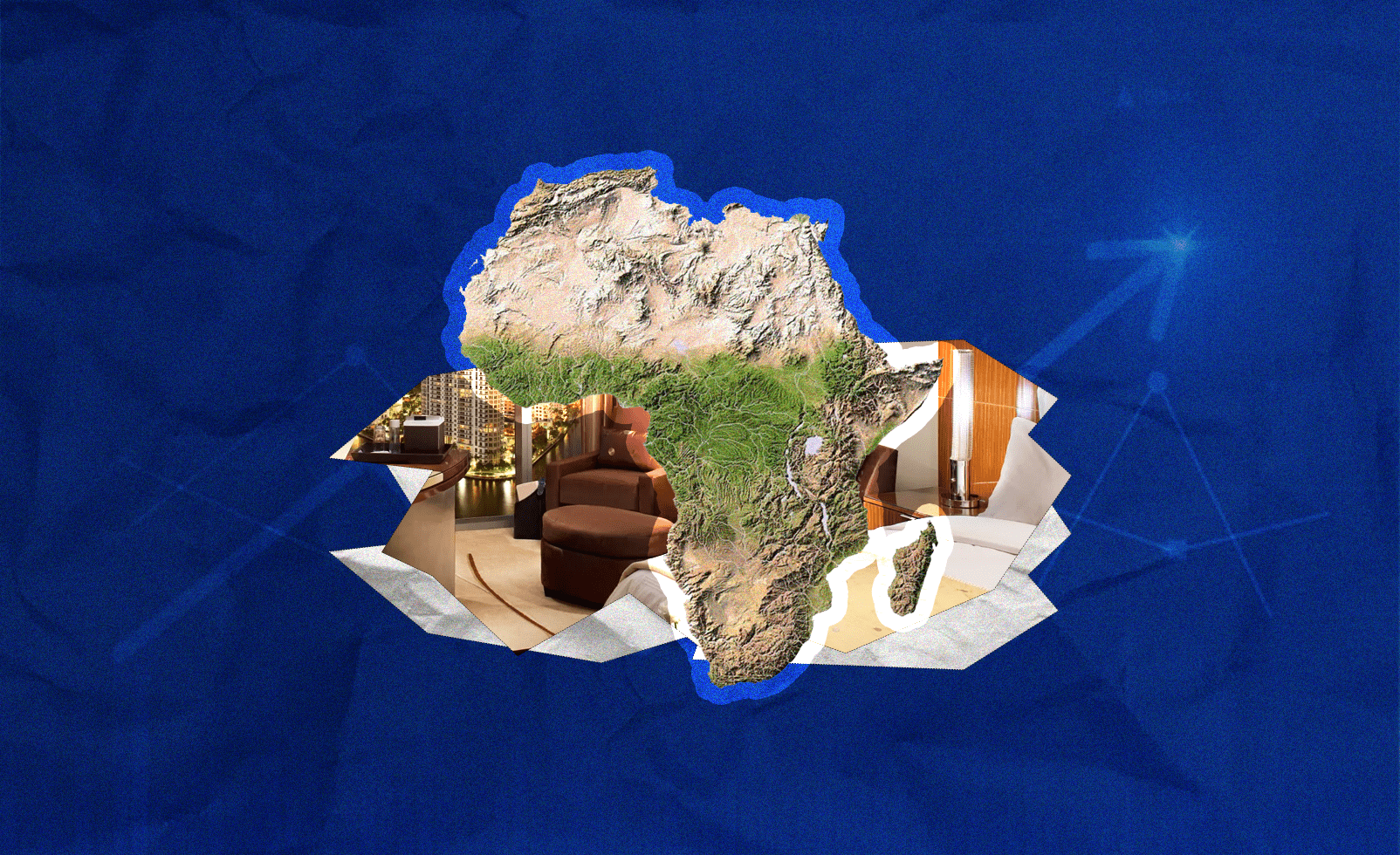

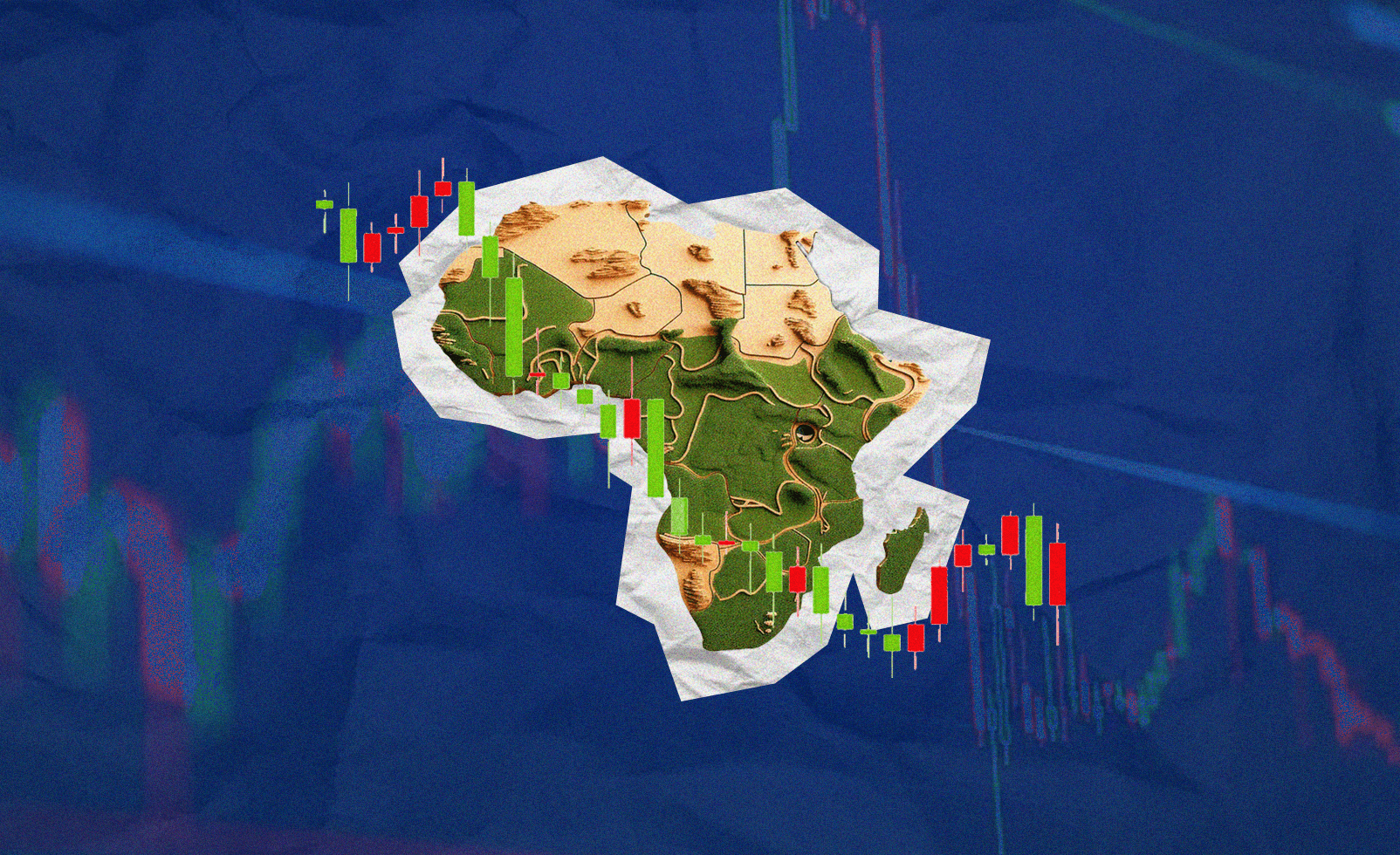

The Lagos hospitality market continues to exhibit healthy performance in terms of RevPAR and Average Daily Rates driven by business and leisure activities in Nigeria’s economic powerhouse. Notably, during a turbulent macroeconomic year, ADR grew by 34.96% YoY in 2023. As such, it remains an enticing market for hospitality investors as the most prominent market in Sub-Saharan Africa in terms of pipeline volume.

Breakdown of Lagos Hospitality Pipeline. Source: Estate Intel

Despite having one of the highest pipeline percentages in 2023, we saw few hotel completions last year at 374 keys (Black Diamond Hotel and Delborough Lagos). This year, a supply of 826 keys is expected to be delivered according to data from W Hospitality Group. However, existing macroeconomic headwinds are likely to inhibit the delivery of new stock into the market.

Lagos’ Expected Stock Supply by Year. Source: W Hospitality Group

Trevor Ward of W Hospitality Group notes that “the recovery and resilience of the Lagos hotel market is remarkable, it has outperformed most of the other cities globally, in terms of both demand and pricing. By the end of 2022, both ADR and RevPAR had surpassed pre-pandemic market performance.

Increased demand, and very little additional supply, have resulted in pricing power on behalf of hotel managers, with no great resistance from the market, as increasing prices across the board are a fact of life. 2023 ADR was about 35 per cent above the 2022 figure, well above inflation; at 2019 values the 2023 ADR is approximately 8 per cent higher than that achieved in 2019. We have not previously seen real increases in the ADR for over a decade. Looking forward, 2024 and 2025 promise to bring continued strong performance, with hardly any new hotels due to open.”

Download the 2024 Lagos Real Estate Development Pipeline Report for more insight into the performance of the Lagos hospitality market in the past year.

As always, we love your feedback! Join the conversation on Instagram and LinkedIn and let us know what you think about the performance of the Lagos hospitality market.

Related News

You will find these interesting

Bisi Adedun . September 2024

The Lagos State Governor, Gov. Babajide Sanwo-Olu, has recently announced the signing of Memorandums of Understanding wi...

babajide sanwoolu

ccecc

Dolapo Omidire . August 2024

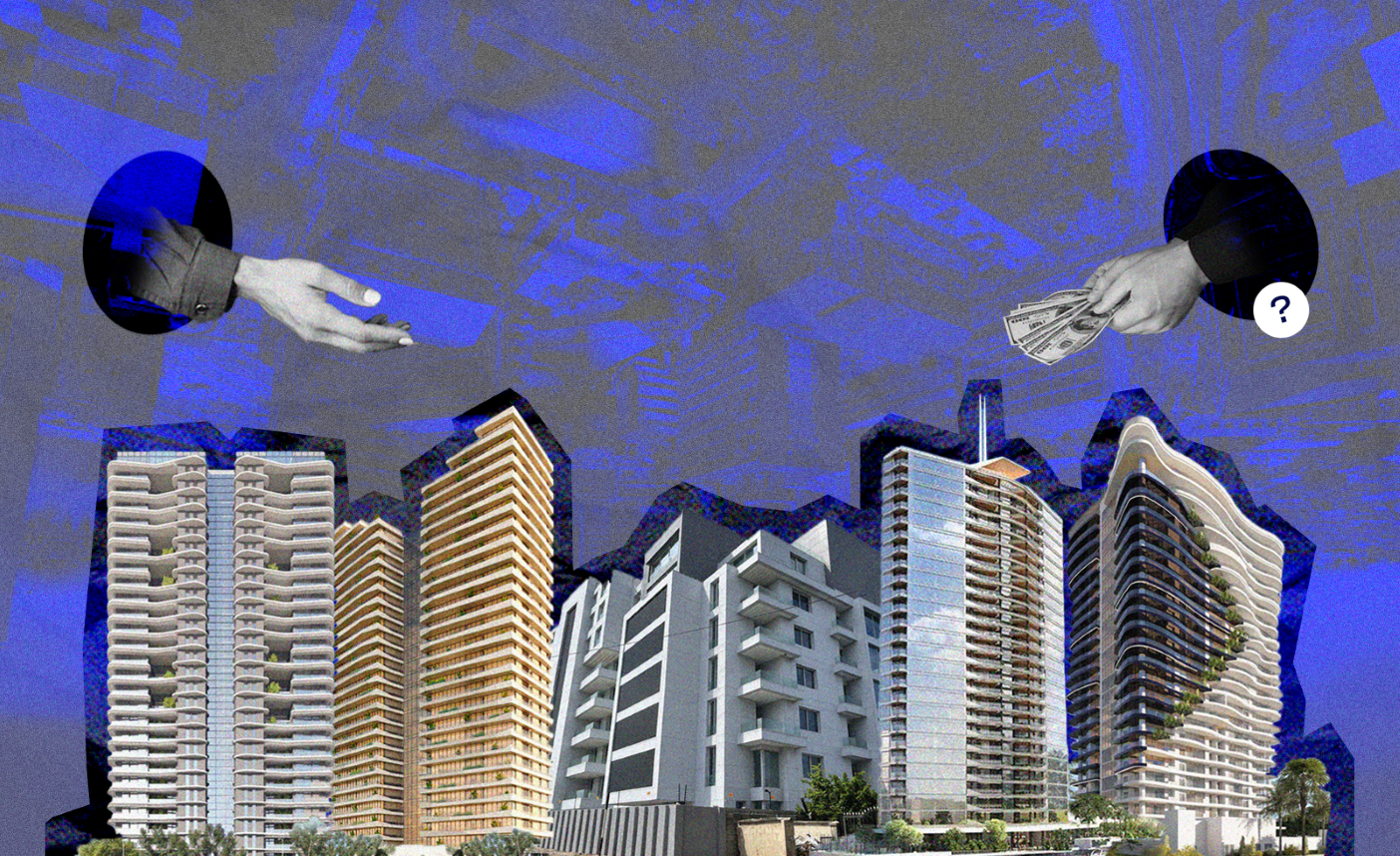

New research from Estate Intel shows that up to 753 apartments with price tags of $ 1 million or more are currently unde...

belmonte prive

cuddle by cadwell

Linah Amondi . August 2023

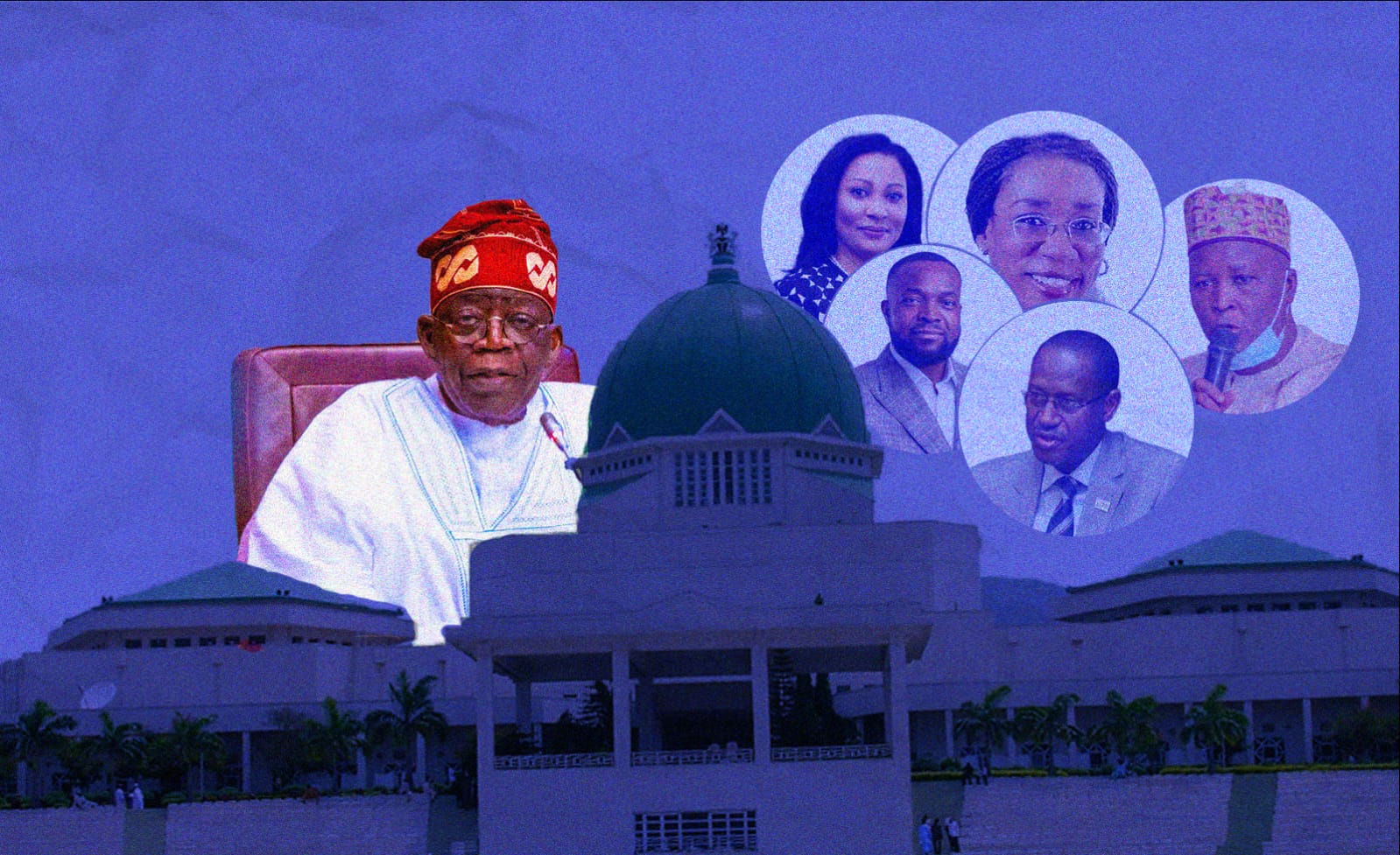

President Bola Tinubu’s list of ministerial appointees in Nigeria is out! Here are the real estate and related sector mi...

Nigeria ministers

Nigeria Real Estate